This Month’s Poll

Do you enjoy reading breaking tax and financial news in Knowledge Report? Please tell us why/why not?Provincial Tax Round Up 2024

With all the news around the release of the April 16 federal budget in the busiest weeks of tax season, you may have missed what’s happened in provincial taxes for 2024. Here’s a provincial tax round up to help you make sense of client queries you might get about relocations in 2024 as relates to personal tax changes. Which is the best province to move to, from a tax filing point of view? Personal tax budget highlights include:

With all the news around the release of the April 16 federal budget in the busiest weeks of tax season, you may have missed what’s happened in provincial taxes for 2024. Here’s a provincial tax round up to help you make sense of client queries you might get about relocations in 2024 as relates to personal tax changes. Which is the best province to move to, from a tax filing point of view? Personal tax budget highlights include:

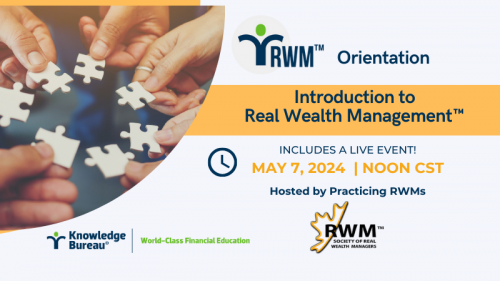

Clients Concerned About Budget Announcements? RWMs are Poised to Help!

Are you alarmed by the recent department of finance and CRA’s budget announcements? Are you feeling like you and your clients are drowning in quicksand? You don’t want to miss this Real Wealth Management Program orientation session, where you will have an opportunity to hear from 7 of Canada’s most influential thought leaders as they have a roundtable budget discussion. Learn more about the RWM™ Designation program and how a Real Wealth Management approach can help your clients achieve financial peace of mind through the collaborative multi-stakeholder strategies aimed at building sustainable inter-generational wealth after taxes, fees and inflation.

Are you alarmed by the recent department of finance and CRA’s budget announcements? Are you feeling like you and your clients are drowning in quicksand? You don’t want to miss this Real Wealth Management Program orientation session, where you will have an opportunity to hear from 7 of Canada’s most influential thought leaders as they have a roundtable budget discussion. Learn more about the RWM™ Designation program and how a Real Wealth Management approach can help your clients achieve financial peace of mind through the collaborative multi-stakeholder strategies aimed at building sustainable inter-generational wealth after taxes, fees and inflation.

What’s In The Big April 30 Tax Bill – Register by May 15 to Decipher What’s New

Last week , on the tax filing deadline of April 30, 2024, the Federal Government tabled a 663-page Notice of Ways and Means Motion to introduce many of the provisions of the April 16 Federal Budget. Included in the Bill, the Budget Implementation Act, 2024, No. 1 were the following provisions; check out how they impact filing at the virtual CE Savvy Summit on May 22 – earn 15 CE Credits, too :

Last week , on the tax filing deadline of April 30, 2024, the Federal Government tabled a 663-page Notice of Ways and Means Motion to introduce many of the provisions of the April 16 Federal Budget. Included in the Bill, the Budget Implementation Act, 2024, No. 1 were the following provisions; check out how they impact filing at the virtual CE Savvy Summit on May 22 – earn 15 CE Credits, too :

Bare Trust Compliance Threat Not Over

Although, in general, bare trust filings received a CRA reprieve for the April 2, 2024 tax filing deadline, other obligations remain and will carry non-compliance penalties. Specifically, CRA has stated that the T3 Return and Schedule 15 (Beneficial Ownership Information of a Trust) will not be required for the 2023 tax year unless the CRA makes a direct request for them.

Although, in general, bare trust filings received a CRA reprieve for the April 2, 2024 tax filing deadline, other obligations remain and will carry non-compliance penalties. Specifically, CRA has stated that the T3 Return and Schedule 15 (Beneficial Ownership Information of a Trust) will not be required for the 2023 tax year unless the CRA makes a direct request for them.

The Increasing Reliance on Public Pensions: Things Have Changed

Things have changed for Canadians in their pre-retirement planning period. High interest, inflation and consumer debt are eroding away “savings room” for private savings, and longevity risk is increasing. As a result, preserving access to indexed public pensions – the CPP and the OAS - is now more important than ever in retirement income planning. Doing so is complex. That’s why, well informed tax and financial advisors can add significant value.

Things have changed for Canadians in their pre-retirement planning period. High interest, inflation and consumer debt are eroding away “savings room” for private savings, and longevity risk is increasing. As a result, preserving access to indexed public pensions – the CPP and the OAS - is now more important than ever in retirement income planning. Doing so is complex. That’s why, well informed tax and financial advisors can add significant value.

Financial Literacy: Why the Federal Budget Does it a Disservice

The April 16 federal budget proposed capital gains taxes that penalize those who have used their knowledge, skills and resources to make responsible financial decisions and has widely promoted tax and financial concepts that are not quite on the mark. That introduces the potential for three unfortunate outcomes: uncertainty that stifles investment and initiative, increased financial illiteracy and worse, potential injustices when tax changes are politicized to pit one generation against another. Fortunately, tax and financial advisors can help to restore shaken confidence in their important roles as educators and intermediaries. Here are the issues to consider:

The April 16 federal budget proposed capital gains taxes that penalize those who have used their knowledge, skills and resources to make responsible financial decisions and has widely promoted tax and financial concepts that are not quite on the mark. That introduces the potential for three unfortunate outcomes: uncertainty that stifles investment and initiative, increased financial illiteracy and worse, potential injustices when tax changes are politicized to pit one generation against another. Fortunately, tax and financial advisors can help to restore shaken confidence in their important roles as educators and intermediaries. Here are the issues to consider: