The UHT May Be Cancelled, But Vacancy Taxes Remain

As tax professionals, you are keenly aware of the constant changes our federal government makes to the Income Tax Act. Adjustments are made, and you must adapt. Not often, though, is a tax eliminated altogether. But in the case of the Underused Housing Tax (UHT), that is exactly what has happened – it was cancelled in the federal budget of November 4, 2025, but Canada’s underused housing taxes have not been eliminated. Here’s what you need to know for tax season 2026.How Much Can You Contribute to an FHSA?

It’s now possible to contribute up to $8,000 per year to your new First Home Savings Account (FHSA), starting in 2023 – this year! Have you opened an account yet? Some financial institutions are starting to offer the plan and it is a great way to save on a tax preferred basis for a new home. It’s also important to open the account because no FHSA contribution room is earned until the year that you do. Following is a checklist to review with your family members, or in the case of professional tax, bookkeeping or financial advisors, with your clients and their younger family members.

It’s now possible to contribute up to $8,000 per year to your new First Home Savings Account (FHSA), starting in 2023 – this year! Have you opened an account yet? Some financial institutions are starting to offer the plan and it is a great way to save on a tax preferred basis for a new home. It’s also important to open the account because no FHSA contribution room is earned until the year that you do. Following is a checklist to review with your family members, or in the case of professional tax, bookkeeping or financial advisors, with your clients and their younger family members.

CWB – Take Time to Refresh and Educate

Canada Worker’s Benefit (CWB) is a refundable credit of up to $1,428 for singles and $2,461 per family which is received when you file a tax return and earn “working income”, a term that is not defined by CRA. There are other criteria, described below. This provision deserves a refresh, because one-half of the CWB claimed on the tax return will be pre-paid for the following year in three instalments: July, October, and January.

Canada Worker’s Benefit (CWB) is a refundable credit of up to $1,428 for singles and $2,461 per family which is received when you file a tax return and earn “working income”, a term that is not defined by CRA. There are other criteria, described below. This provision deserves a refresh, because one-half of the CWB claimed on the tax return will be pre-paid for the following year in three instalments: July, October, and January.

Mental Health Awareness Month: Real Wealth Managers Can Alleviate Financial Stressors

Perhaps appropriately positioned after the April tax filing deadline, May is Mental Health Awareness month. Nearly 1-in-4 Canadians say money is their top source of stress, and the number of people who feel regularly stressed almost doubled following the pandemic. Good news: almost 1-in-2 Canadians seek advice from a financial professional and/or engage financial literacy to strengthen their financial knowledge, and that can help. Working with a Real Wealth Manager™ can be particularly effective. Here’s why:

Perhaps appropriately positioned after the April tax filing deadline, May is Mental Health Awareness month. Nearly 1-in-4 Canadians say money is their top source of stress, and the number of people who feel regularly stressed almost doubled following the pandemic. Good news: almost 1-in-2 Canadians seek advice from a financial professional and/or engage financial literacy to strengthen their financial knowledge, and that can help. Working with a Real Wealth Manager™ can be particularly effective. Here’s why:

Automatic Tax Filing: Answer to Low Benefits Uptake?

Did you know that about 10 to 12% of Canadians don’t file a tax return and they are missing out on potentially $1.7 billion in benefits? The government plans to make it possible for millions more to get their refundable tax benefits, without having to actually file a tax return. Two specific measures are targeted to meeting this goal in the March 28, 2023 federal budget, but will they achieve goals to increase uptake? Here’s what’s proposed for 2024:

Did you know that about 10 to 12% of Canadians don’t file a tax return and they are missing out on potentially $1.7 billion in benefits? The government plans to make it possible for millions more to get their refundable tax benefits, without having to actually file a tax return. Two specific measures are targeted to meeting this goal in the March 28, 2023 federal budget, but will they achieve goals to increase uptake? Here’s what’s proposed for 2024:

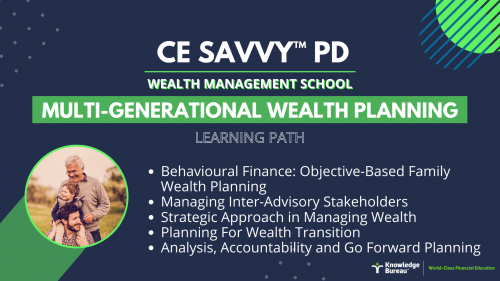

CE Savvy™ Collection – Multi-Generational Wealth Planning

Multi-generational wealth planning is fraught with potential failure because it’s so hard to get everyone on the same page – mom & dad, the kids and the grandkids! But it’s possible with a multi-stakeholder process you can easily learn with our new CE Savvy™ Collection of five micro-courses! You too can learn how the process of objective-based planning and joint decision making can really move a Real Wealth Management™ plan forward, and bring huge value to clients who are struggling with how to best plan for the future. The five micro-courses are entitled:

Multi-generational wealth planning is fraught with potential failure because it’s so hard to get everyone on the same page – mom & dad, the kids and the grandkids! But it’s possible with a multi-stakeholder process you can easily learn with our new CE Savvy™ Collection of five micro-courses! You too can learn how the process of objective-based planning and joint decision making can really move a Real Wealth Management™ plan forward, and bring huge value to clients who are struggling with how to best plan for the future. The five micro-courses are entitled:

Advanced Serious Illness Planning: Learn a Better Way

Here’s a sobering thought: when people get seriously ill, only 1 in 3 patients get the medical care that is right for them. This, according to Dr. Daren Heyland who will explain more in two important sessions at the May 24 CE Summit. Families are ill-prepared to make the life and death decisions they are called upon to make on the patient’s behalf and consequently, says Dr. Heyland, they suffer significant anxiety and stress. Things can get worse if the patient survives. If the person survives their serious illness but is left vulnerable and incapacitated, many families struggle to provide the best medical and personal care possible and end up quarreling about how to use the patient’s resources. The current ways of planning ahead for future illness are not working….but you can be part of the change.

Here’s a sobering thought: when people get seriously ill, only 1 in 3 patients get the medical care that is right for them. This, according to Dr. Daren Heyland who will explain more in two important sessions at the May 24 CE Summit. Families are ill-prepared to make the life and death decisions they are called upon to make on the patient’s behalf and consequently, says Dr. Heyland, they suffer significant anxiety and stress. Things can get worse if the patient survives. If the person survives their serious illness but is left vulnerable and incapacitated, many families struggle to provide the best medical and personal care possible and end up quarreling about how to use the patient’s resources. The current ways of planning ahead for future illness are not working….but you can be part of the change.