CRA Shut Down: Communicate Proactively Before Long Weekend

Did you know that Canada Revenue Agency (CRA) will be undergoing a digital migration on the September long weekend, starting Friday August 29 at 8:00 p.m. and ending Tuesday at 6:00 am September 2, with the proviso that this possibly could last til September 3? What could go wrong? Plenty.Your Practice: Empathy is the Currency of Trust

Tax and financial advisors agree: more than ever, empathy is a key ingredient of successful advisor-client relationships. This was borne out in a presentation by Craig Dowden, Ph.D., at the recent Distinguished Advisor Conference. Registration is now available for this annual event, being held in San Diego, November 6 – 9, 2016.

Tax and financial advisors agree: more than ever, empathy is a key ingredient of successful advisor-client relationships. This was borne out in a presentation by Craig Dowden, Ph.D., at the recent Distinguished Advisor Conference. Registration is now available for this annual event, being held in San Diego, November 6 – 9, 2016.

It’s Not Too Late to Take the New Basic T1 Tax Course

Knowledge Bureau’s recently updated T1 Professional Tax Preparation – Basic course introduces a proven process for consistently accurate T1 tax preparation services, with a professional client interview and documentation management system, now featuring case studies using 2015 professional tax software.

Knowledge Bureau’s recently updated T1 Professional Tax Preparation – Basic course introduces a proven process for consistently accurate T1 tax preparation services, with a professional client interview and documentation management system, now featuring case studies using 2015 professional tax software.

Ontario Registered Pension Plan Postponed

The Ontario government has reversed it's January decision to launch the Ontario Registered Pension Plan (ORPP) in January 2017 regardless of what the federal government does with CPP. This week, the Ontario government has announced that it will work together with the federal government to achieve the mutual goal of improving pensions.

The Ontario government has reversed it's January decision to launch the Ontario Registered Pension Plan (ORPP) in January 2017 regardless of what the federal government does with CPP. This week, the Ontario government has announced that it will work together with the federal government to achieve the mutual goal of improving pensions.

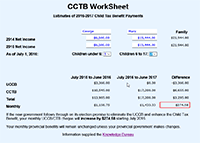

Max the RRSP Now to Maximize the New CTB

Families who wish to maximize the anticipated new Child Tax Benefit (CTB) for 2016/2017 have less than two weeks left to reduce 2015 net income using an RRSP contribution. The deadline is February 29. For these reasons, Knowledge Bureau has updated its Income Tax Estimator to assist with the calculations.

Families who wish to maximize the anticipated new Child Tax Benefit (CTB) for 2016/2017 have less than two weeks left to reduce 2015 net income using an RRSP contribution. The deadline is February 29. For these reasons, Knowledge Bureau has updated its Income Tax Estimator to assist with the calculations.