Fall Reviews: Did You Claim the Disability Tax Credit?

The Disability Tax Credit (DTC) may be one of the lesser understood tax credits but for your clients who have a disability it is critically important. Having a conversation with your clients about health changes in their life circumstances and those of their loved ones could help them access this tax credit.A Perfect Graduation Gift

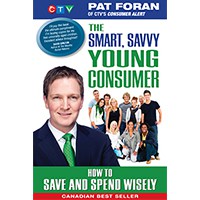

The Smart, Savvy Young Consumer provides "must-have" financial education for a new generation! It's about launching a financial life with the knowledge and skills to make responsible decisions. A perfect graduation gift for young adults ready to go out on their own. Buy 3 books, get 1 free! Use PromoCode: KBRSPECIAL.

The Smart, Savvy Young Consumer provides "must-have" financial education for a new generation! It's about launching a financial life with the knowledge and skills to make responsible decisions. A perfect graduation gift for young adults ready to go out on their own. Buy 3 books, get 1 free! Use PromoCode: KBRSPECIAL.

Featured Course: Tax Planning for Corporate Owner-Managers

Advise private business owners and managers about the best way to manage their compensation to maximize the amount of after-tax income available. Gain a solid understanding of options available when constructing compensation packages, of the salary-dividend-bonus mix to maximize tax efficiency, and of constraints imposed by income tax and other laws so you can provide sound advice to your clients on compensation planning all year long.

Advise private business owners and managers about the best way to manage their compensation to maximize the amount of after-tax income available. Gain a solid understanding of options available when constructing compensation packages, of the salary-dividend-bonus mix to maximize tax efficiency, and of constraints imposed by income tax and other laws so you can provide sound advice to your clients on compensation planning all year long.