AUTHREP Changed July 15

Since July 15, the "Authorize a Representative" service in EFILE, accessed through tax software, will no longer be available. Tax professionals must now use the Represent a Client (RAC) portal to request online access to a client’s account.Interest and Inflation Rate Hikes Ahead? Time to Manage Real Wealth

After holding interest rates at 1.25 percent since January, the Bank of Canada appears ready for raise the rate in its next announcement, July 11, when many economists expect it to increase to 1.5 percent. This small jump could affect millions of Canadians and is an opportunity for advisors and clients to lean in and plan for change.

After holding interest rates at 1.25 percent since January, the Bank of Canada appears ready for raise the rate in its next announcement, July 11, when many economists expect it to increase to 1.5 percent. This small jump could affect millions of Canadians and is an opportunity for advisors and clients to lean in and plan for change.

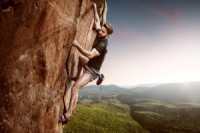

Time for a Leadership Reboot: What’s Your Passion Statement?

Your passion statement is all about the “why?” When’s the last time you took the time to reconsider why you do what you do? Whether you’re a proprietor or have leadership aspirations to grow your career, this is the driving force that is the basis of your business goals. Join Knowledge Bureau to recommit to your life’s work at November’s Business Builder Retreat.

Your passion statement is all about the “why?” When’s the last time you took the time to reconsider why you do what you do? Whether you’re a proprietor or have leadership aspirations to grow your career, this is the driving force that is the basis of your business goals. Join Knowledge Bureau to recommit to your life’s work at November’s Business Builder Retreat.