Immediate Expensing Rules: Good Tax Policy?

Over the course of the last two federal budgets (April 16, 2024 and November 4, 2025), the rules for claiming Capital Cost Allowance (CCA) have been uncertain. The proposal to extend immediate expensing rules for certain acquired assets were paused for over a year and then re-introduced in a series of four complex measures which together with new rules for Scientific Research and Experimental Development have become known as the “Productivity Super-Deduction”. A backdrop appears below. The key question: will this complexity be effective as an economic stimulator?It’s Not Too Late to Take the New Basic T1 Tax Course

Knowledge Bureau’s recently updated T1 Professional Tax Preparation – Basic course introduces a proven process for consistently accurate T1 tax preparation services, with a professional client interview and documentation management system, now featuring case studies using 2015 professional tax software.

Knowledge Bureau’s recently updated T1 Professional Tax Preparation – Basic course introduces a proven process for consistently accurate T1 tax preparation services, with a professional client interview and documentation management system, now featuring case studies using 2015 professional tax software.

Ontario Registered Pension Plan Postponed

The Ontario government has reversed it's January decision to launch the Ontario Registered Pension Plan (ORPP) in January 2017 regardless of what the federal government does with CPP. This week, the Ontario government has announced that it will work together with the federal government to achieve the mutual goal of improving pensions.

The Ontario government has reversed it's January decision to launch the Ontario Registered Pension Plan (ORPP) in January 2017 regardless of what the federal government does with CPP. This week, the Ontario government has announced that it will work together with the federal government to achieve the mutual goal of improving pensions.

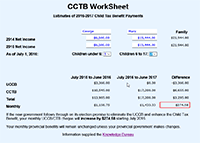

Max the RRSP Now to Maximize the New CTB

Families who wish to maximize the anticipated new Child Tax Benefit (CTB) for 2016/2017 have less than two weeks left to reduce 2015 net income using an RRSP contribution. The deadline is February 29. For these reasons, Knowledge Bureau has updated its Income Tax Estimator to assist with the calculations.

Families who wish to maximize the anticipated new Child Tax Benefit (CTB) for 2016/2017 have less than two weeks left to reduce 2015 net income using an RRSP contribution. The deadline is February 29. For these reasons, Knowledge Bureau has updated its Income Tax Estimator to assist with the calculations.

Federal Budget: Tax Reforms Coming Soon

A tell-tale sign the federal budget is right around the corner was the February 12 meeting of the Finance Minister with private sector economists for their forecasts on the Canadian and global economies. This this year, a number of significant tax changes are expected, if the newly elected Liberal government’s election platforms are implemented.

A tell-tale sign the federal budget is right around the corner was the February 12 meeting of the Finance Minister with private sector economists for their forecasts on the Canadian and global economies. This this year, a number of significant tax changes are expected, if the newly elected Liberal government’s election platforms are implemented.

Canada and Switzerland Agree to Jointly Fight Tax Evasion

On February 5, the Finance Minister announced that Canada and Switzerland have signed a Joint Declaration which will see the two countries exchange financial account information automatically. With this agreement, CRA expects to curb tax evasion by Canadian residents who earn income in Switzerland but do not report it on their Canadian tax returns.

On February 5, the Finance Minister announced that Canada and Switzerland have signed a Joint Declaration which will see the two countries exchange financial account information automatically. With this agreement, CRA expects to curb tax evasion by Canadian residents who earn income in Switzerland but do not report it on their Canadian tax returns.