This Month’s Poll

Do you enjoy reading breaking tax and financial news in Knowledge Report? Please tell us why/why not?Average to Awesome: Keys to Building Scalable Practices | Brian Mennis

The turbulent 2020’s are almost behind us, from a business planning point of view. Building relationships that will amplify results, simply requires a new approach, according to Brian Mennis, author Average to Awesome of Harbourfront Wealth Management who is leading a session on Building Scaleable Practices at the Acuity Conference for Distinguished Advisors (DAC) on November 11. Mentorship of both new advisors and new clients is a challenge; he says, because what people want is just different. The question is: do you have what it takes to thrive and build your business under such an environment? If not, what’s the cure?

The turbulent 2020’s are almost behind us, from a business planning point of view. Building relationships that will amplify results, simply requires a new approach, according to Brian Mennis, author Average to Awesome of Harbourfront Wealth Management who is leading a session on Building Scaleable Practices at the Acuity Conference for Distinguished Advisors (DAC) on November 11. Mentorship of both new advisors and new clients is a challenge; he says, because what people want is just different. The question is: do you have what it takes to thrive and build your business under such an environment? If not, what’s the cure?

Looking to Become a Fellow of Distinguished Financial Services (FDFS™)?

Would you like to earn the coveted FDFS™ designation? These Distinguished Fellows are honored for their distinguished services as influential thought leaders, who have demonstrated a commitment to the noble cause of teaching and writing by engaging others in the high standards of knowledge they share. In doing so, they have also demonstrated an extraordinary commitment to shaping the future of the tax, accounting and financial services industries. Here’s how you can get involved:

Would you like to earn the coveted FDFS™ designation? These Distinguished Fellows are honored for their distinguished services as influential thought leaders, who have demonstrated a commitment to the noble cause of teaching and writing by engaging others in the high standards of knowledge they share. In doing so, they have also demonstrated an extraordinary commitment to shaping the future of the tax, accounting and financial services industries. Here’s how you can get involved:

CEI - A Bittersweet Tax Break for the Economic Times

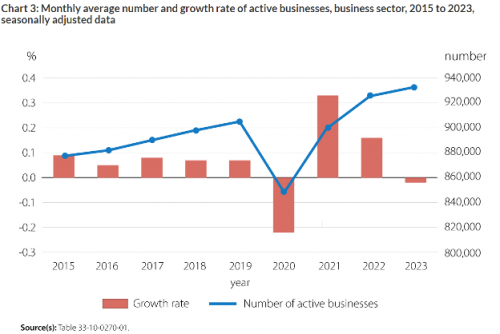

The legislation to implement the Canadian Entrepreneur Incentive (CEI) was released on August 12 and while the provision has been improved from its debut in the April 16 federal budget, its effectiveness in offsetting the negative effects of the capital gains inclusion rate increases when an entrepreneur sells the shares of the company, may still be muted. The reality of the journey to a successful disposition is fraught with risk, as businesses are opening and closing at unprecedented rates. Another major flaw according to the CFIB, is the long list of entrepreneurs in important industries, who are still excluded.

The legislation to implement the Canadian Entrepreneur Incentive (CEI) was released on August 12 and while the provision has been improved from its debut in the April 16 federal budget, its effectiveness in offsetting the negative effects of the capital gains inclusion rate increases when an entrepreneur sells the shares of the company, may still be muted. The reality of the journey to a successful disposition is fraught with risk, as businesses are opening and closing at unprecedented rates. Another major flaw according to the CFIB, is the long list of entrepreneurs in important industries, who are still excluded.

CGIR Rules: Draft Legislation Released

The technical details for the significant tax changes arising out of the April 16 Federal Budget regarding changes to the Capital Gains Inclusion Rate (CGIR) that took effect on June 25, 2024 were finally released on August 12, absent explanatory notes or even a table of contents, although a Backgrounder issued on June 10. The announcement provides for a brief consultation period with a deadline of September 3. Join us for a technical course on the matter from an audit defence perspective in our virtual CE Savvy Summit on September 18. In the meantime, a perusal of the legislation has identified significant updates throughout the Income Tax Act.

The technical details for the significant tax changes arising out of the April 16 Federal Budget regarding changes to the Capital Gains Inclusion Rate (CGIR) that took effect on June 25, 2024 were finally released on August 12, absent explanatory notes or even a table of contents, although a Backgrounder issued on June 10. The announcement provides for a brief consultation period with a deadline of September 3. Join us for a technical course on the matter from an audit defence perspective in our virtual CE Savvy Summit on September 18. In the meantime, a perusal of the legislation has identified significant updates throughout the Income Tax Act.

Tax Audits are Working for the CRA

The government has invested in the Canada Revenue Agency because it brings great returns. Consider the results in the latest CRA Departmental Report, described below. Then, consider the additional powers and money behind them granted to the department in the latest federal budget and in particular the concerning new provisions that introduce a Notice of Non-Compliance into the mix.

The government has invested in the Canada Revenue Agency because it brings great returns. Consider the results in the latest CRA Departmental Report, described below. Then, consider the additional powers and money behind them granted to the department in the latest federal budget and in particular the concerning new provisions that introduce a Notice of Non-Compliance into the mix.

New Credentials for CE Savvy Summit Students!

Knowledge Bureau is pleased to introduce a new Diploma in Advanced Family Tax Compliance. This comprehensive program is ideal for experienced tax accountants and wealth advisors who require updating in the latest tax and economic changes from Finance Canada and CRA in order to help clients meet tax filing compliance requirements and family wealth planning objectives. The program comprises of four online courses, 5 chapters each, and 4 virtual CE Summit events.

Knowledge Bureau is pleased to introduce a new Diploma in Advanced Family Tax Compliance. This comprehensive program is ideal for experienced tax accountants and wealth advisors who require updating in the latest tax and economic changes from Finance Canada and CRA in order to help clients meet tax filing compliance requirements and family wealth planning objectives. The program comprises of four online courses, 5 chapters each, and 4 virtual CE Summit events.