2014 Income Tax Estimator Now Available

December is just around the corner and it’s high time to finalize the estimation of 2013 taxes payable income in order to determine the correct amount of the final tax instalments (December 15 for all taxpayers except farmers, who must submit one instalment on December 31).

This is also the time to estimate 2014 income and to establish the correct tax remittances for 2014.

With last week’s announcement of the 2014 indexation rate of 0.9%, the Knowledge Bureau’s Income Tax Estimator has been updated for 2014 indexed federal tax rates, tax brackets and personal amount. Provincial taxes have been updated based on previously announced changes and provincial indexation factors where applicable. However amounts may still change as provincial budgets are brought forward.

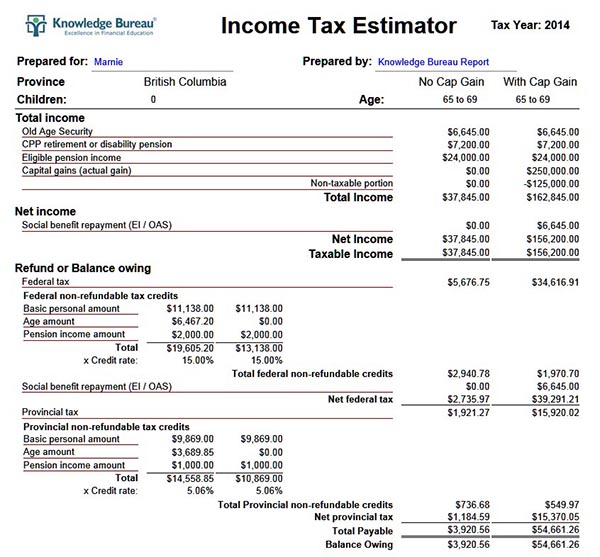

Example: Marnie, age 65, is a widow living on OAS, a CPP survivor and her RRIF accumulations transferred from her deceased husband. She lives in BC and estimates her CPP at $7,200 and her minimum RRIF withdrawal for 2014 will be $24,000. In 2014 she plans to sell a vacation property and hopes to generate a capital gain of $250,000. She’d like to know how this capital gain will increase her tax bill.

By doing a side-by-side comparison of her income with and without the capital gain, we see the following:

The capital gain adds $50,740.70 to her tax bill (20.3% of the gain). Her Age amount is reduced to zero, she is required to repay all of her OAS, and since her taxable income now exceeds $150,000, she is subject to tax at the highest provincial marginal rate in the new $150,000+ tax bracket.

How could she mitigate these clawbacks and pay at a reduced rate?

One way would be to receive the proceeds of the sale over five years rather than all at once. By taking a reserve for 80% of the gain in 2014 she would only add $25,000 to her taxable income, which results in a partial Age amount, no clawback of her OAS, and keeps her in the second tax bracket both at the federal and provincial levels. Ignoring inflation, this plan would save her about $14,000 in taxes over the five-year period.

This tool can be used in tax and financial planning to avoid OAS, EI, and tax credit clawback zones, plan income splitting within the family, and RRSP contributions. A free trial is available.