2026 Automobile Deduction Limits Released – Finally

Evelyn Jacks

The government finally announced the 2026 automobile deduction limits on January 14, 2026, significantly later than in prior years, when the announcements typically came in December. Here are the new rates, as of January 1, 2026:

- CCA Limits – Class 10.1 Vehicles. The ceiling limit for capital cost allowances (CCA) for Class 10.1 passenger vehicles has increased from $38,000 to $39,000, before tax. This applies to acquisitions of new and used vehicles on or after January 1, 2026.

- CCA Limits – Class 54 Vehicles. The ceiling for CCA for Class 54 zero-emission passenger vehicles remains at $61,000, before tax for acquisitions of new and used vehicles) in 2026.

- Leasing Costs. Deductible leasing costs remain at $1,100 per month, before tax, for new leases entered into on or after January 1, 2026.

- Interest Costs. The maximum allowable interest deduction remains unchanged at $350 per month for new automobile loans entered into on or after January 1, 2026.

- Tax Exempt Allowances. The limit on the deduction of tax-exempt allowances paid by employers to employees who use their personal vehicle for business purposes in provinces increases by one cent to 73 cents per kilometre for the first 5,000 kilometres driven, and to 67 cents for each additional kilometre. For the territories, the limit increases by one cent to 77 cents per kilometre for the first 5,000 kilometres driven, and to 71 cents for each additional kilometre.

- Taxable Benefit Calculation. The general prescribed rate used to determine the taxable benefit for the personal portion of automobile expenses paid by their employers to employees remains the same at 34 cents per kilometre for 2026. If employed principally in selling or leasing automobiles, the rate used to determine the employee’s taxable benefit remains at 31 cents per kilometre for 2026.

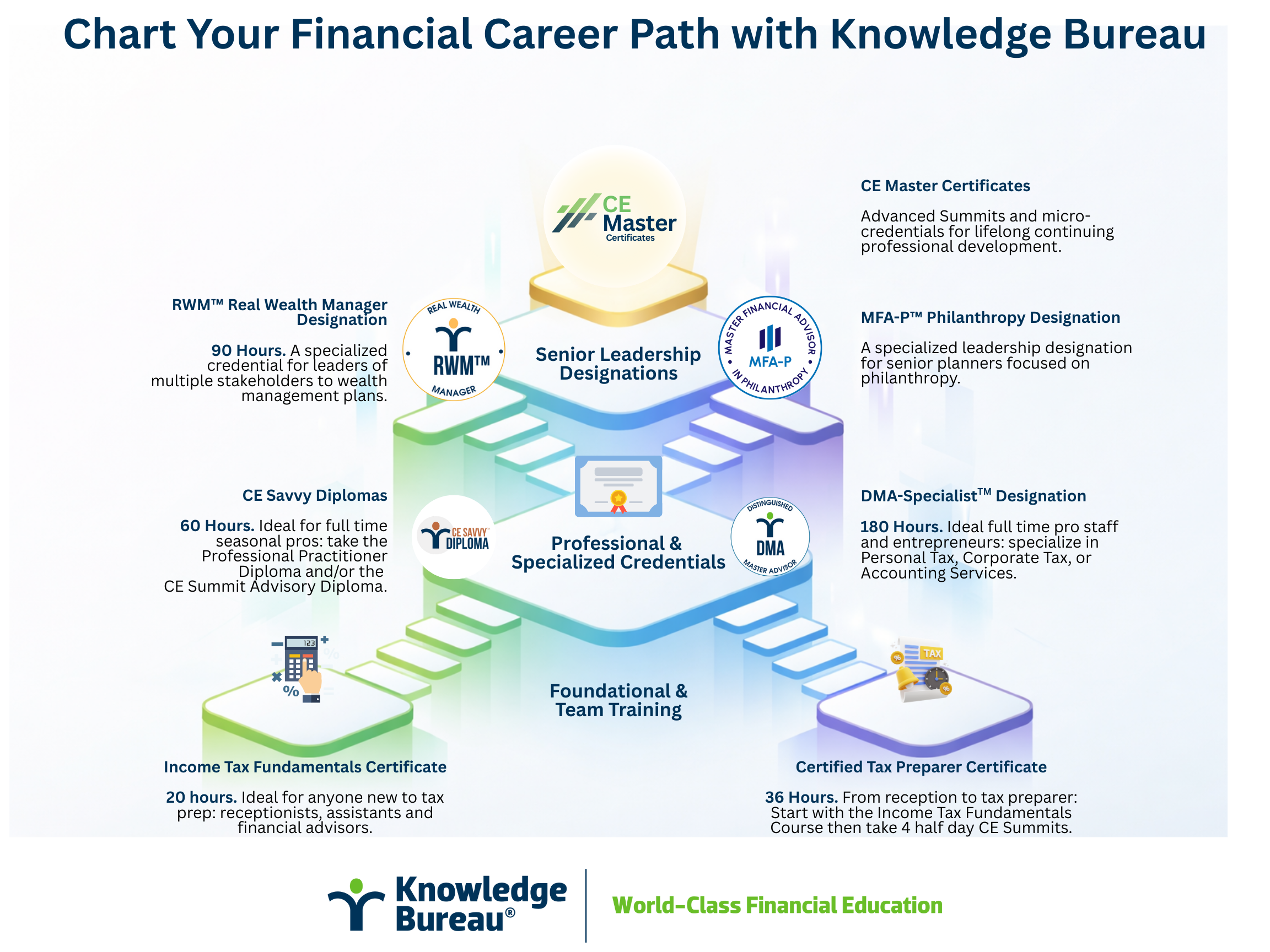

For additional educational resources throughout tax season, consult Evergreen Explanatory Notes, available at no extra charge with the enrolment in any Knowledge Bureau Certificate Course.

Here are your world class educational options, in a handy infographic: