A Challenge for New Clients: How to Choose a Trusted Advisor

Evelyn Jacks

If you’re in business for yourself, you have a unique opportunity to build wealth in an asset class that others don’t have: equity in a business enterprise that some day may be sold for millions of dollars. In addition, that business can spin off income for family members that can provide significant tax advantages, done well. Understanding how to realize on this asset requires the help of a trusted financial advisory team. Who should be on that team and how do you find them? This is a challenge your next new business clients may wrestle with. Here are some tips on how you can open discussions to help them:

Who Should Be on the Team? Consider who might be on your financial advisory team, over time. That’s important, because you may need to pull in different financial specialists as you grow your business and your wealth.

How Do You Choose the Team? How to assemble this team and get the results you want can be as difficult as assembling the right executive team in your business. When you set your goals for your personal financial results, ask the right questions and work on one strategic plan with each of these stakeholders to your success, the results can be phenomenal. Consider the following checklist in selecting your financial advisory team:

CHECKPOINT: CHOOSING YOUR FINANCIAL ADVISORY TEAM

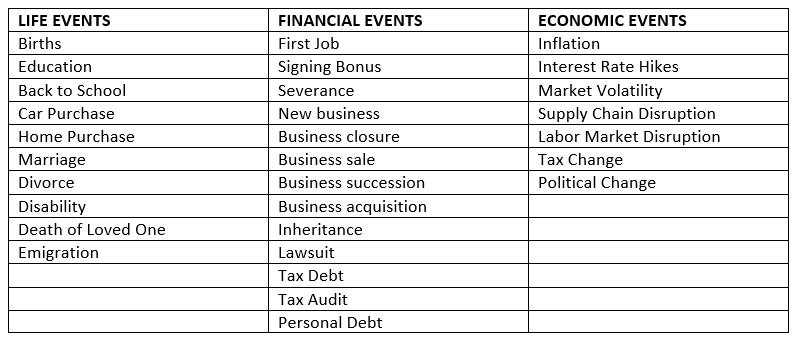

1. Write down your top ten most pressing financial questions. The following are events that cause people to make financial decisions. It follows the model for conducting a thorough interview taught in the RWM™ Real Wealth Manager Designation Program. Advisors: Ask your new client: Do you have questions that need answers?

2. Make a list of the financial advisors you need to talk to about your top, most burning questions. For example, you may need to include tax accountants who specialize in personal, corporate, trust and cross-border taxation, legal advisors who specialize in personal, tax and corporate law, banking specialists, personal and business wealth advisors, insurance specialists, business valuators and succession planning specialists, to name a few. Advisors: Working with a Real Wealth Manager can help to manage all the professional stakeholder and make sure they are all on the same page with your strategic plan.

3. Seek referrals. Ask your family, friends, business mentors and/or associates for references to the financial professionals on your list. Ask them why/how they have had good or bad experiences. What area of specialization was particularly helpful to life, financial or economic circumstances that were encountered? Advisors: Suggest ways to help your clients identify those specialized services for different lifecycle decisions: education, retirement, estate planning for example.

4. Understand Service levels. Bookkeepers may or may not offer tax preparation services; personal tax consultants may not be experienced in corporate, trust or cross-border matters; accountants may not work with smaller businesses, legal advisors may specialize in drafting contracts on intellectual property management, but not wills or representing you to the Tax Court of Canada. Advisors: Your clients may be confused by these different service levels; help them articulate objectives and budget required and make appropriate introductions.

5. Interview at Least Three. Talking to at least three professionals in each category of specialization may seem like a lot of work, but it will help you to receive a broad sampling of important factors in a long term relationship: potential quality and breadth of service, how interested the advisor is in acting as an educator and mentor to your family and most important, signs of a commitment to the stewardship of your family’s financial legacy: a client-first approach that makes you feel comfortable in discussion of personal goals and in asking important questions – no matter how simple they may seem. Advisors: Are you an active listener? Do you have questions for your clients? Do you make suggestions that add value to you? Can you learn from this person? Are you positioned to be a trusted stakeholder to your clients’ personal and family goals, as well as their business goals?

6. Consider the Network. Does your prospective financial advisory team come with a broad referral network? That’s important as your business grows and as your needs change within the family. Advisors: If you don’t have all the expertise, are you well connected?

7. Fees. Paying professional fees can be a great wealth eroder, or the smartest investment you can make in helping you reach your goals. Find out what they are, how they are charged and when, and don’t be shy about this. Advisors: Are you prepared to have this conversation and put your fee and service structure in writing as part of your engagement letter?

8. Give a Trial. Ask the advisors you are thinking of working with to do a small job for you. Evaluate the quality of the work, ability to meet your deadlines and the solution itself. Was there as solid follow-up and accountability standard? This person is poised to work with you in trust; the trial needs to have great, not just good results. Review the accuracy of the work and whether it met the intended scope of the assignment. Advisors: Do you have a client onboarding procedure that exceeds expectations and results in retention and referrals?

9. Make your Decision. Choose the advisor(s) you are most comfortable with. One of them will likely evolve to become the most trusted advisor and will help you manage the entire team of stakeholders to your financial peace of mind. Advisors: Do you have an evaluation process so that you can share testimonials of the client experience with you and your firm?

Bottom line: You can’t do everything yourself. This applies to your business as well as your personal wealth management goals. Choosing a professional financial advisory team is important. It can exponentially help you build wealth. But in addition, it can set up your personal and work family to carry on in the way you intended, should something happen to you.

Advisors: Consider earning the RWM™ designation to help your clients find their most trusted advisor.

Additional Educational Resources: Check out the following Designation Program from Knowledge Bureau: Real Wealth Manager Designation Program. Find out more about the professionals offering this service across Canada and, if you are interested, how to become a RWM™ yourself.