Tech & Tax: Career Opportunities Bright in Tax Preparation Industry

Tax complexity aside, there has rarely been a more promising career opportunity in the tax preparation industry than today, especially for younger people who are jazzed by the potential of AI and digital transactions with the tax department. Based on the latest Departmental Plan released by CRA on June 17, 2025, key initiatives include the prioritization of AI and a continued digital transformation. So if you love technology, chances are good that you might also love a career in taxation. Knowledge Bureau can help. Here’s what you need to know:

The Backdrop. We have come a long way since Finance Minister Edgar Benson, through a Royal Commission on Taxation, championed a tax reform and guiding we still follow today. It was especially ground-breaking, as it anticipated a move to a computer-based compliance system, entered into massive computers by data entry operators back in the 70s. Today, taxpayers transact in an almost entirely digital relationship with CRA.

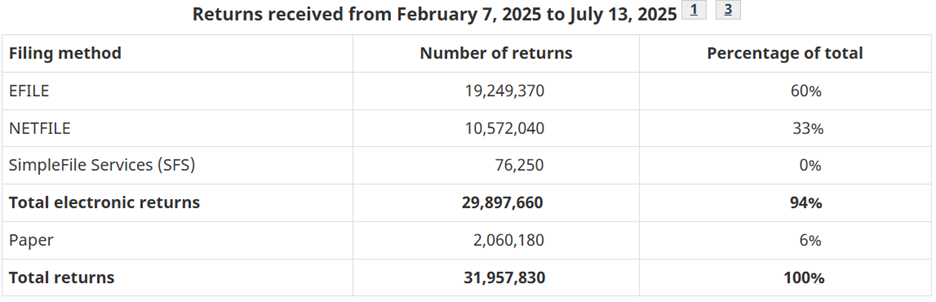

Only 6% of Canadians are still filing a paper tax return (it’s required in certain cases). That equates to over 29 million Canadians who file electronically – an incredible feat – as shown below.

Footnote 1 Rounded to the nearest 10. Footnote 3 Percentages are rounded to nearest whole number; so individual components may not add to totals

However, information going into CRA has largely been perfected, it hasn’t been smooth sailing once it gets there, especially in 2025, when internal computer changes at CRA resulted in incomplete information that affected tax filing accuracy.

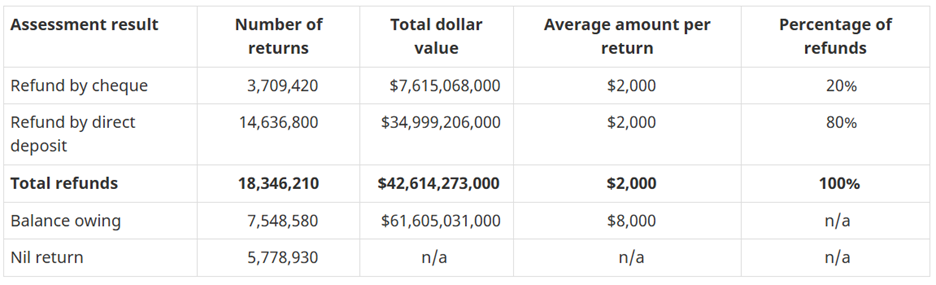

While the majority of tax filers are filing for refunds – 58% - or just over 18 million filers, increasingly taxpayers are owing money. About 7.5 million people owed approximately $8,000 each this year. In fact, $20 billion more was owed to CRA vs. refunds payable. Consider the statistics from the latest tax filing year: February 7, 2025 to July 14, 2025:

Tax Collections Ramp Up, Digitally. For these reasons, collections activities will continue to be a big part of the CRA mandate. According to CRA’s commissioner, Bob Hamilton: “This year, we’ve made an explicit objective to increase the rate of resolution of the tax debt.”

Again technology plays a big role. Paying CRA is increasingly digital and in some cases mandatory. For example, payments due to CRA that are over $10,000 must be sent electronically; otherwise there is a penalty of $100 for failure to comply without a good reason. Given that the average balance owing is just under $8000, many taxpayers will be required to transact electronically in the future, just to pay their annual balance and that will include investors and business owners.

Tax Accountants Must Come Up to Mach Speed. Digitization at CRA affects the tax accounting profession as well. Those who electronically file more than 5 tax returns and get paid for the services, now must use EFILE rather than NETFILE.

New in Audit Defense. Even digital currency is now is a source of audit. CRA is to receive $51.6 Million in 2024-25 then $7.3 Million annually (based on the April 16, 2024 federal budget) to implement a new annual reporting regime for crypto-asset services providers resident in Canada, or those who carry on business in Canada and provide exchange transaction services for crypto-assets. By 2027, for the 2026 tax year, these businesses must provide information on their customers – resident and non-resident, individual or corporations – who are transacting with them.

Bottom Line: Take a close look at a new career as a Personal or Corporate Tax Specialist, especially considering the many rewarding ways to help people who must transact with their tax department (over 30 million of them) as it moves more aggressively into digitization and away from personal interaction.

The role is critical because human interaction is required to ensure that Canadians pay only the correct amount of tax and no more, receive the right amount of their social benefits and have a strong, knowledgeable advocate when the increasingly robotic world at CRA puts up language and process barriers.