Canada’s Most Comprehensive Tax & Financial Planning Updates: Audit Defence

Audit activity is on the rise—and the stakes are higher than ever. With a federal target to collect $3.75 billion through increased fines and penalties, along with widespread T-slip errors and confusion around capital gains, tax audits are expected to surge in 2025.Tax and financial advisors must be prepared to respond. Join us at the CE Savvy Summit: Audit Defence on September 17 for a deep dive into the latest audit trends, case studies, and defence strategies. Learn directly from leading experts and get practical tools to better protect your clients. Register by September 10 to take advantage of early-bird rates. Special pricing available for Diploma and Team member registrations.

Register now! Ideal for team training, bring two or more for only $495 each!

“Excellent education about issues facing Canadian Taxpayers and Preparers of Canadian Income Taxes!” -Robyn Garlough

What Will You Learn? Instructor-Led Sessions

- Tax Audit Defence Kit

- Technology Update from Our Software Partners

- The Globe-Trotting Investor

- New Trends in Tax Audit Defence & Appeals

- RWM™ Round Table: Caught in the Cross- Hairs of Wealth Erosion

Check out the full agenda and register online.

Course Components:

- Virtual instructor-led event (recorded for replay)

- 5 Chapter Online Course

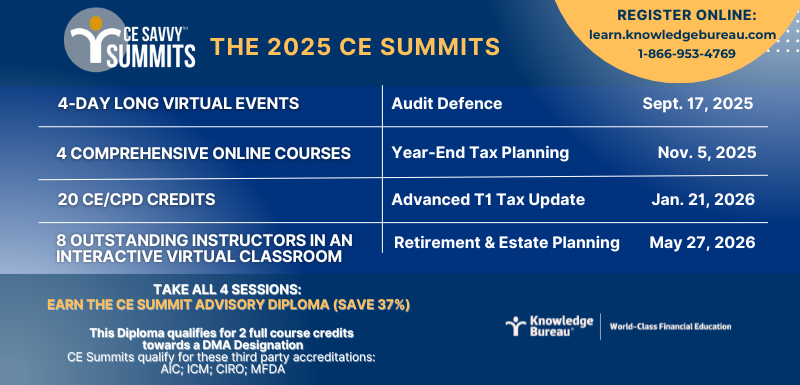

- CE Accreditation: 20 CE/CPD Credits with KB. Third party accreditation: AIC; ICM; CIRO; MFDA

Online Course Content:

- Tax Compliance & The Burden of Proof

- Statutory Requirements & CRA’s Administrative Powers

- Canadian & US Investments

- Owning Property as a Non-Resident

- US Estate and Gift Tax

“Love the format, love doing it online, I always learn something. I always get the cobwebs shaken out for the issues and learn new things as well.” – Sherril Sirrs, CMA