Final Payments Finally: Canada Carbon Rebate for Small Business

Evelyn Jacks

A portion of fuel charge proceeds from the price on pollution was promised to eligible small and medium-sized businesses via the Canada Carbon Rebate for Small Businesses (CCRSB). Now, the final payments for the 2024-2025 year will be coming before the end of 2025, in designated provinces. That announcement was made on November 14. Here’s what to expect:

What is the CCRSB? This is an automatic, refundable tax credit provided directly to eligible businesses. Corporations do not have to apply for it; rather, CRA will be refunding it directly to eligible businesses.

What is the eligibility criteria? Businesses had to have filed their tax returns for 2024 by July 15, 2025. They will have reported they have fewer than 499 employees in the calendar year, with at least one employee having worked in a province where the federal fuel charge applied.

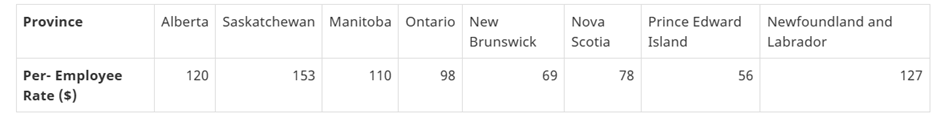

How much is payable? On a per-employee basis, the amounts are as follows in eligible provlnces:

Why are the amounts different? The amounts payable can vary between jurisdictions due to differences in the amount of fuel charge proceeds collected and the number of employees in each designated province.

Is it taxable? No.

Bottom line: Approximately 590,000 businesses are expected to receive a payment over the next couple of weeks. Be sure you inform your clients to look for it and let CRA know if there have been any changes in contact information.