Last updated: November 19 2025

Contributing to an RDSP Releases Lucrative Grants

Evelyn Jacks

What’s new in year end tax planning? Getting back to basics when it comes to providing for disabled family members, specifically the use of a lucrative program, the Registered Disability Savings Plan, which has had poor pick-up since its inception in 2008. And that’s too bad, because the accompanying grants and bonds available from the federal government could make a huge difference, especially in estate planning with parents worried about leaving a vulnerable adjust. Here is what you need to know:

The Backdrop. The cumulative number of individuals who had ever opened an RDSP since the program's inception in 2008 is only 303,389. As of the end of 2023 that represents only 34.9% of eligible Canadians. It’s quite possible one of the reasons is that to take advantage of it, a tax return needs to be filed and the instructions are complex.

What is an RDSP? The Registered Disability Savings Plan (RDSP) and it was designed to accumulate capital and tax deferred income for the benefit of a disabled person in retirement. It works in much the same manner as the RESP or Registered Education Savings Plan. In particular, there are also some interesting and lucrative government matching programs associated with the RDSP.

Who qualifies? Any person eligible to claim the Disability Amount can be the plan holder and beneficiary of an RDSP. The plan can be established by them or by an authorized representative.

Who can open an RDSP? Since 2012, a “qualifying family member” can open and be the planholder of an RDSP for mentally disabled adults. This QFM included a parent, spouse, or common‑law partner if the disabled person did not otherwise have a legal representative.

What Deadline has Changed? This expanded measure was to expire on December 31, 2015 but then was twice extended until December 31, 2018 and again until December 31, 2023. However, the March 28, 2023 federal budget announced a further extension to December 31, 2026 and also expanded the definition of a QFM. This will now include adult siblings of the beneficiary of the plan. This sibling can act as the holder of the account when the disabled person doesn’t have a legal representative.

Who can contribute to the RDSP? Anyone can contribute to an RDSP; they need not be a family member. This fact has prompted many philanthropists to open accounts for the vulnerable, especially because of the wonderful opportunity to leverage individual contributions with government matches, discussed later.

Budget 2023 extended the temporary measures that allow a qualifying family member, who is a parent, spouse or common-law partner, to open an RDSP and be the plan holder for an adult whose capacity to enter into an RDSP contract is in doubt and who does not have a legal representative. The original measure, set to expire on December 31, 2023, will now be extended to the end of 2026. Also, effective with the June 22, 2023, Royal Assent, this measure began to apply to siblings of disabled beneficiaries who are over age 18.

When is the contribution deadline? The contribution year for RDSP ends on December 31 each year.

Are contributions deductible? No, they are not tax deductible.

Is there a time limit for making contributions? Yes, contributions can only be made until the end of the year in which the beneficiary turns 59.

The CDSG and CDSB. As mentioned, there is a powerful opportunity to leverage individual contributions to the RDSP and make the investment even more meaningful to the recipients. A contribution to an RDSP generates two forms of direct financial assistance from government, the Canada Disability Saving Grant and the Canada Disability Saving Bond. Family income is calculated in the same manner as it is for Canada Education Savings.

Canada Disability Saving Grant: If the family net income is below the threshold for the 22% federal tax bracket, the CDSG

- 300% of the first $500 plus

- 200% of the next $1,000

If the family net income is above the threshold for the 22% federal tax bracket, the CDSG is 100% of the first $1,000 contributed.

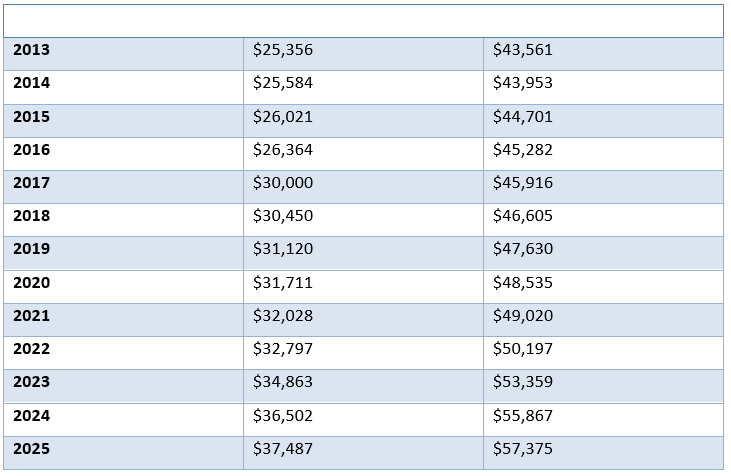

Canada Disability Savings Bond: Unlike the CDSG, there is no requirement that a contribution be made to a RDSP before a savings bond contribution is available. The maximum annual CDSB entitlement is $1,000 and is earned where family income does not exceed certain net income threshholds

Catch-Up of RDSP Grants and Bonds. When an RDSP is opened, starting in 2011, CDSG and CDSB entitlements will be calculated for the 10 years prior to the opening date (but after 2008) based on the beneficiary’s family income in those years.

CDSB entitlements from the catch-up period will be paid into the plan in the year the plan is opened. When contributions are made to the plan, the CDSG rate earned by those contributions will be paid as if the contributions were made in the year that the entitlements were earned. Where the entitlement will be paid at different rates, the grants will be calculated at the highest rate first.

Maximum Grant Thresholds. The annual maximums for grants and bonds on unused entitlements are:

- $10,500 for grants; and

- $11,000 for bonds.

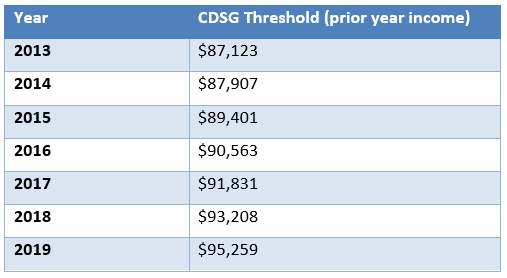

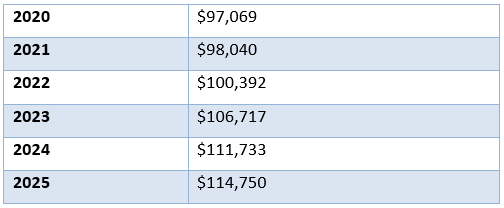

The grant thresholds by year are: For the Canada Disability Savings Grant:

Bottom Line: Tax and financial professionals have an important opportunity to discuss the RDSP and these generous grants and bonds before year end. It is one way to bring some financial peace of mind in planning with parents and siblings of disabled people.