Should Deposit Insurance Be Raised from $100,000?

Evelyn Jacks

The Canada Deposit Insurance Corporation’s (CDIC) deposit protection is automatically applied when investors deposit money with a member bank or credit unions. The object is to protect depositors should a bank fail. The good news? There has not been a deposit insurance payout in almost 30 years. But now the framework is under review and both advisors and their clients may wish to weigh in, in particular because the deposit insurance limit is currently only $100,000 in specific deposit categories.

The Backdrop. What’s covered? There are several categories of products covered:

- Deposits in Canadian or foreign currency (including via payroll, Interac e-transfer, or cheque)

- Guaranteed Investment Certificates (GICs)

- Other term deposits

- High interest savings accounts

- Debentures

- Principal Protected Notes

- Prepaid Cards

What’s not covered? The following investments:

- Mutual funds

- Stocks and bonds

- Exchange Traded Funds (ETFs)

- Cryptocurrencies

The nine protected categories:

- Deposits held in one name

- Deposits held in joint accounts

- Deposits held in trust

- Deposits held in registered accounts: RRSP, RRIF, TFSA, FHSA, RESP, RDSP.

How much is Protected?

The deposit insurance limit of $100,000 applies to eligible deposits in each of the nine categories above when the deposits held at CDIC member institutions. The limit of $100,000 is applied per category, per depositor, and the framework applies equally to personal and corporate deposits.

Total coverage above $100,000 is possible there are multiple accounts at the same institution:

- Across deposit insurance categories: by holding deposits in more than one category at the same member institution, depositors are able to access coverage above $100,000.

- Across member institutions: by holding deposits with more than one CDIC member institution, depositors are able to access coverage above $100,000

- Across affiliated member institutions within a banking group

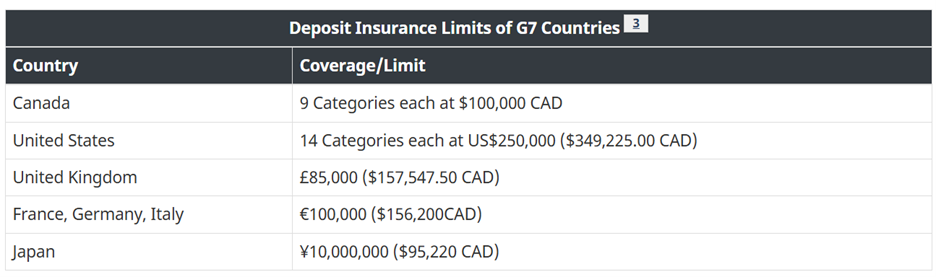

The Consultation. Finance Canada is leading the consultation on changes required to the federal deposit insurance framework, in collaboration with the Canada Deposit Insurance Corporation and other financial sector agencies. The $100,000 limit compares as follows with other G7 countries:

Why Change Now? According to the preamble to the Consultation Paper, the global banking system experienced significant volatility in 2023, including the failure of three regional banks in the United States and Credit Suisse, a global systemically important bank.

Canada’s financial sector performed well during both the pandemic and the March 2023 events, however, the fact that banks could experience large runs that could culminate in failure, triggered a review of the important role deposit insurance can play in promoting stability.

In addition, there have been significant change trends which speak to the need for review:

- The unpredictability of US trade policy which has caused a sharp increase in uncertainty and market volatility.

- Changes in savings patterns and wealth transfers (in part due to changing demographics) and

- Increasing digitalization and innovation in the financial sector including the fact that more Canadians are engaging with their financial service providers through online banking/financial services platforms.

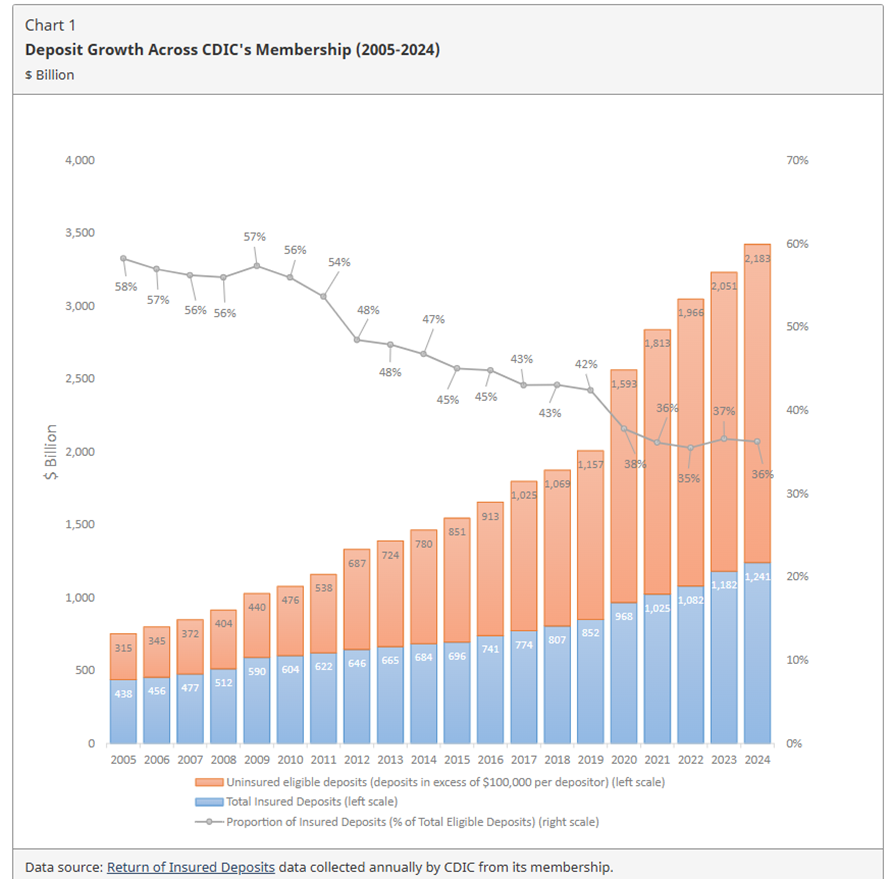

- Investor behavior is changing: there has been a significant growth in uninsured deposits: uninsured eligible deposits grew by 594 per cent from $315 billion in 2005 to $2,183 billion in 2024, while insured deposits grew by 183 per cent from $438 billion to $1,241 billion over the same time period, as illustrated in the chart below.

What to comment on. Specifically, the government wants to hear views on the following:

- Increasing the deposit insurance limit to $150,000 per deposit category;

- Providing a deposit insurance limit of $500,000 per deposit category to non-retail depositors;

- Extending coverage for temporary high balances in certain cases; for example, for depositors experiencing significant life events, for an enumerated list of life events (real estate transactions, inheritances, divorce settlements, damage settlements, insurance payouts); for a period of six months; and with a deposit insurance limit of $1 million.

- Enhancing depositor understanding through improved disclosure; that is to require a CDIC member institution provide its customers with tailored information about the amount of insured deposits they hold at that member institution.

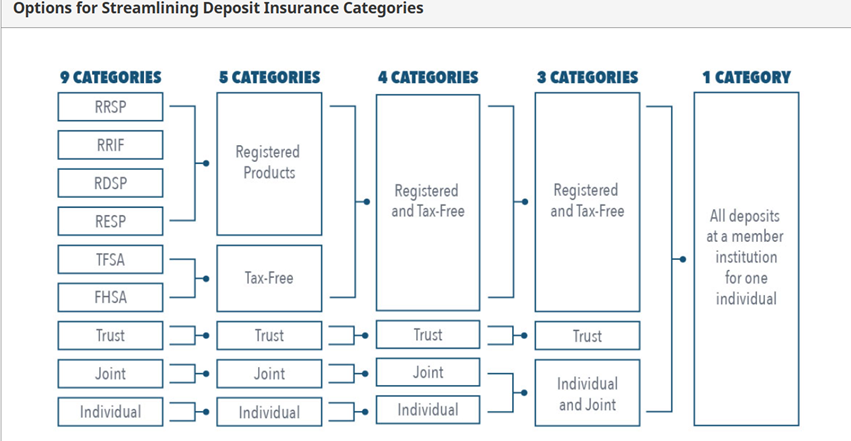

- Streamlining the framework to four categories by merging the registered and tax-free categories and making coverage for the merged category unlimited; potentially as shown below:

The government is favoring an approach that includes only 4 categories: Registered and Tax Free, Trust, Joint and Basic.

The last review of the deposit insurance framework began in 2014. It led to changes effective 2018, which extended coverage to foreign currency deposits, treated all registered products in the same manner, and improved rules for trust deposit accounts.

Here’s how to provide feedback: Review the consultation paper and then email comments with “Deposit Insurance Review” as the subject line by September 26, 2025: to ">DepositInsuranceReview-Examenducadredassurancedepots@fin.gc.ca.

Keep Up with the Latest Breaking tax and economic news and earn CE Credits: