Last updated: September 24 2025

OAS Rates Up, Prescribed Interest Rates Unchanged

Evelyn Jacks

Two pieces of good news for the last quarter of 2025: seniors will get a small raise, but prescribed interest rates at CRA will stay steady after last quarter’s drop in rates. Here’s what you need to integrate into your year end planning activities.

Prescribed interest rates: Q4 – October 1 to December 31.

- 7% - the rate charged on overdue taxes, Canada Pension Plan contributions, and employment insurance (EI) premiums

- 5% - the rate to be paid on non-corporate taxpayer overpayments by the CRA

- 3% - the rate to be paid on corporate taxpayer overpayments by the CRA

- 3% - the rate used to calculate taxable benefits for employees and shareholders from interest‑free and low-interest loans, and for the purposes of drawing up an inter-spousal loan

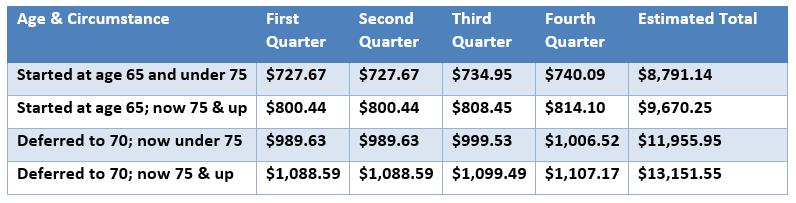

OAS Rates: Based on changes in the Consumer Price Index (CPI), OAS benefits will increase by 0.7% for the October to December 2025 quarter. This means that over the past fiscal year, from October 2024 to October 2025, seniors have received a 1.7% increase in this taxable, income-tested pension.

The taxes generated are offset by the age amount, for those who qualify, age-wise (65 and up) and income-wise (clawback of the $9028 non-refundable credit, that is reduced when individual net income exceeds $45,522.

But remember there is a clawback of the OAS benefit itself – known as a recovery tax – when net income is over $93,444. It is fully clawed back when income if over $148,451 if under 75 and $154,196 if 75 and over.

Here’s a summary of the 2025 OAS benefit payments and total amounts:

Bottom Line. Seasonal changes in prescribed interest and OAS rates provide a great opportunity to initiate conversations about year end tax planning. Your clients may be interested to hear from you to discuss spousal income splitting opportunities in particular.