Opportunity: Canadian Dollar Stabilizes, Somewhat

Evelyn Jacks

Things have started to turn around for the Canadian dollar in the second quarter of 2025. It hit a 22 year low in January of 2025. Investors and property owners, who have been swooning at the high burn rate in their travel plans and property maintenance abroad, may wish to consider recent more positive trends and consider some risk mitigation opportunities now that the dollar is stabilizing somewhat.

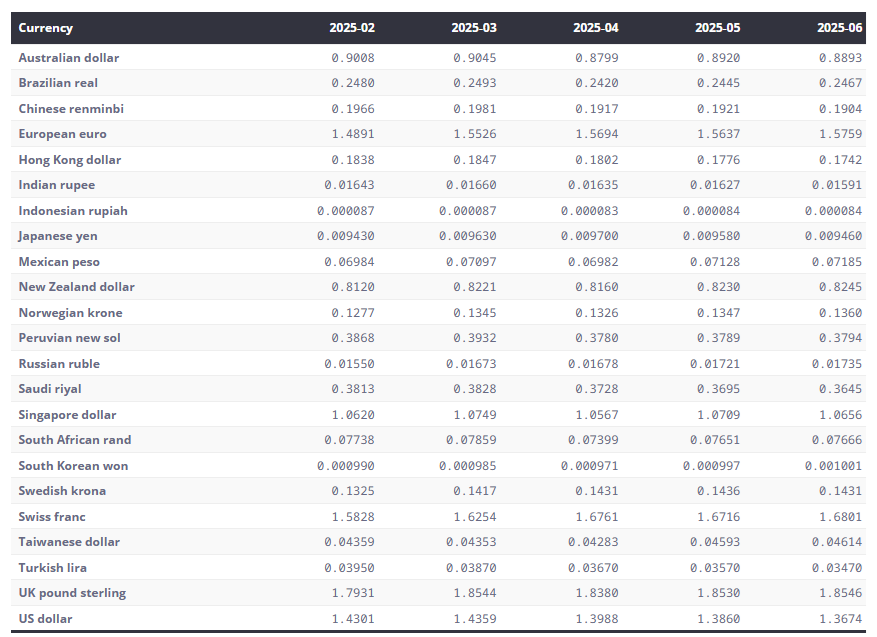

Exchange rates in first half of 2025: The Canadian dollar showed a 3.7 cent improvement by comparison to the US dollar since that low in January. The daily exchange rate to July 8 was 1.36608, as illustrated below in a chart from Trading Economics.

The average exchange rate on the Canadian dollar for the first half of 2025 is also available for calculating currency fluctuations and their tax consequences, from the Bank of Canada, again showing improvement since January, against a variety of currencies:

The Future is Now. There are other factors besides that tariff saga that is affecting Canada’s weak dollar performance according to experts on the subject. Analysts at RBC, for example, report the following as culprits:

- High Consumer Debt. Canadian consumers are carrying a much higher debt load that their US neighbors and that is weighing down domestic spending.

- Mortgage Renewals. Homeowners in Canada have to renew their mortgages periodically, and have recently renewed with higher interest rates. Their US counterparts meanwhile generally will pay a consistent mortgage rate through the lifespan of their mortgage...this not only takes money out of Canadian consumers pockets periodically but causes uncertainty as well. Interest rates, rose dramatically in 2022, dampening consumer spending.

- Uncertainty. Higher levels of uncertainty will affect investors as well as businesses, putting a cloud over the Canadian economy.

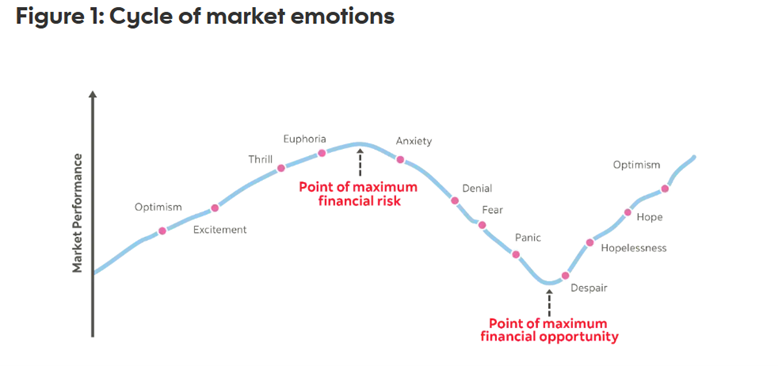

Point of Maximum Potential. Scotiabank has released five strategies that are an interesting read including a chart on the point of maximum financial opportunity in the cycle of market emotions.

With this comes some general advice that has outlasted various market cycles:

- stay calm

- stay invested,

- take a balanced approach to risk and returns,

- diversify your holdings and

- average into market cycles with regular contributions to your investment portfolio.

I would add: pay attention to tax efficiencies that can amplify your returns.

The Bottom Line: If you have clients who feel emotional about the state of financial affairs these days, help them understand the value of working with a professional advisory team. Opportunities can be maximized when you turn market volatility and investor anxiety into a productive relationship that sticks to fundamentals.

Help your clients, especially new investors, learn more about tax and financial literacy to ask better questions and find peace of mind in their decision-making with you.

For educational solutions that are fun and can help you meet those goals, take the Knowledge Bureau’s CE Master Micro-Credential programs. It’s a great invest, sound and predictable: your new knowledge will help you become a more savvy collaborator with an advisory team.