Financial Issues & Answers for Everyone

A thorough analysis of today’s financial news—delivered weekly to your inbox or via social media. As part of Knowledge Bureau’s interactive network, the Report covers current issues on the tax and financial services landscape and provides a wide range of professional benefits, including access to peer-to-peer blogs, opinion polls, online lessons, and vital industry information from Canada’s only multi-disciplinary financial educator.

August 2025 Poll

A public consultation on whether the CDIC’s deposit insurance limit should be raised to $150,000 per deposit category is underway. Do you agree?

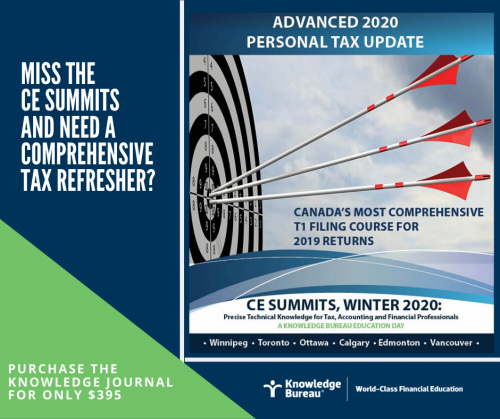

Attendees Rave About the CE Summit Knowledge Journal: Get Yours!

Did you miss the Winter CE Summits? You can purchase the CE Summit January Advanced Tax Update Journals for your team for only $395. Plus, you get the new assignments included for free. Here's why Winter attendees encourage you to get yours:

Charitable Donations by Will: Income or Capital?

Last week at the CE Summits in Vancouver, an interesting question arose with regards to the deductibility of gifts left by a deceased taxpayer to a specific charity in his will. Would that specific bequest qualify for the donations tax credit on the final return, a trust return or both? It turns out, the answer may be neither.

Tax Changes for Employees in 2019

A number of tax changes for employees have been implemented for the 2019 tax filing year which officially begins on February 24 when the CRA opens their electronic gates for EFILE transmissions. What should you know before the tax season begins?

Speak Up: The Government Wants to Know Your Priorities for the Next Federal Budget

The federal government is asking for your opinion in advance of the upcoming federal budget. Four priorities have been brought forward for your consideration, and you can submit your feedback electronically. But, is much of the agenda already set?

New Journalism Tax Credit: No Lines or Forms Released to Claim it Yet

A new maximum non-refundable tax credit of $13,750 per eligible employee is available starting in 2019 for Qualified Canadian Journalism Organizations. The 25% refundable credit will apply to qualifying labour expenditures of up to $55,000 if they are incurred in the tax year beginning on or after January 1, 2019. The trouble is that there is no line on the tax forms for the credit and the required schedules won’t be available until May. Still, the claim must be done on time. Here’s what you need to know: