Are the Tax Stats Right?

Evelyn Jacks

It’s April 30 and there has rarely been more confusion about a tax filing deadline than in 2025! Not only is CRA’s Auto-fill My Return (AFR) service unreliable, the tax filing deadlines themselves have shifted: April 30 for most people, May 1 for trusts with capital gains, June 2 for T1s with capital gains and June 16 for T1s with small business income (proprietorships). Even the income tax filing statistics seems off. Have a look:

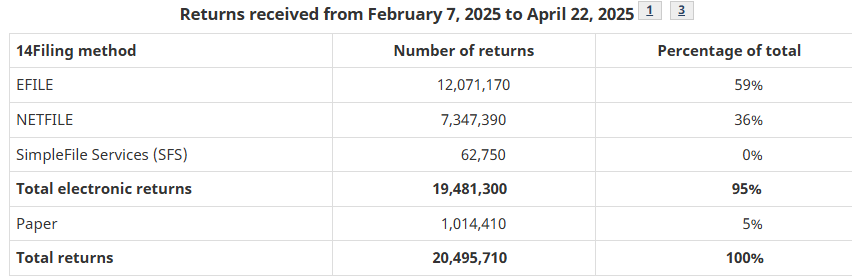

Over 20 million tax returns have been filed this year up to April 22; most of them by EFILE and a predictably negligible number by SimpleFile. Despite repeated attempts, the precious resources CRA continues to pour into this initiative simply (pun intended) doesn’t resonate with the vast majority of “simple” tax filers. Note in the chart below that over 3.5 Million people have filed a nil return; clearly they are not using this service.

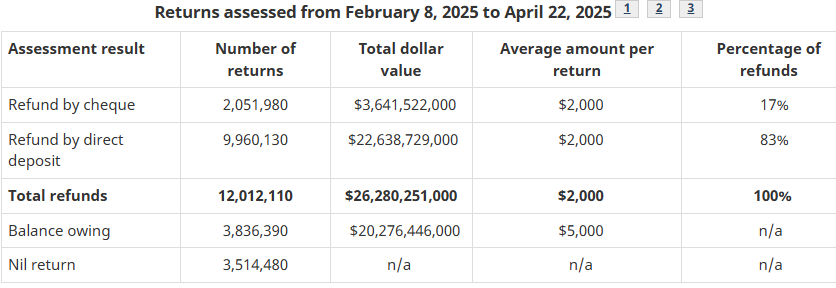

Also, something is amiss with the numbers for refunds and balances due. Over the years, these have generally not been expressed as round numbers. Further, these reported numbers have not changed for a couple of weeks; also unusual:

Bottom line: Given that 95% of Canadians are filing electronically now, CRA must be ready with their digital environment. This has failed dramatically in the 2025 tax filing season. Tax advisors, be ready to make lots of claims under the Taxpayer Relief Provisions for interest and penalties levied by CRA in the annual fall when slip matching exercise. This has the potential to seriously go off the rails, as well.