Audit Potential: Personal Services Businesses

Evelyn Jacks

In 2022 CRA launched a pilot project on the activities of Personal Services Businesses (PSBs) and the companies that hire them. Unfortunately, it appears there is tax audit pain ahead for some of these entities, and potentially those who hire them. Tax preparers, it seems, haven’t gotten the T2 filing requirements right, either.

The Backdrop. When an individual taxpayer (the payee) is performing services for a company (the payer) through a corporation, there are three basic ways to define the relationship. In the first two cases, when services are provided either as a consultant, or an independent contractor, CRA considers be a similar relationship to the hiring of a self-employed unincorporated person exists

But when there is a PSB, the issue is that the individual would likely be considered an employee, and the nature of those services would otherwise constitute an employer-employee relationship – in other words at a subordinate level. The only difference is that the payer is paying the individual’s corporation; not the individual. The tax consequences, are different in this case.

What is a PSB. An individual may be operating a PSB if the following conditions are met:

- The incorporated employee who is performing services, is also a specified shareholder of the corporation; this is an individual who at any time in the year directly or indirectly owns at least 10% of the issued shares of any class of the capital stock of the corporation or of any other corporation that is related to the corporation.

- The individual would otherwise be considered an employee if the corporation did not exist; this includes a set of criteria including the degree of control the individual has, whether the individual is responsible for buying their own tools and equipment, the hiring of their own employees, responsibility for financial risk, investments and management, and the opportunity for profits.

- The PSB corporation does not employ more than 5 full-time employees throughout the tax year; and

- The amounts received by the PSB for services were not received from a related secondary corporation.

The Tax Shock. The problem is that the PSBs’are not eligible for important deductions, such as the small business deduction (SBD). This makes a significant difference in the taxes payable and it turns out a large number of the businesses which participated in the study (64%) were claiming the SBD.

Here are the consequences: For Canadian-controlled private corporations claiming the small business deduction (SBD), the net tax rate is 9% (4.5% for manufacturers of qualifying zero-emission technology). But a PSB cannot claim the SBD, or the general rate reduction. In other words, a PSB is subject to full federal and provincial corporate tax rates on all taxable income, plus an additional 5% tax. That generally works out to about 33% plus provincial taxes.

Further, the only deductions allowed to a PSB are:

- Salary and wages, benefits or allowances paid to the incorporated employee

- Expenses associated with selling property or negotiating contracts

- Legal expenses incurred in collecting amounts owing

The Industries Affected. Of the corporations that participated in the study, about 10% indicated that they were likely to be using the services of a PSB. In addition, most of these businesses were in three sectors:

- 35% - Transportation and warehousing with 95% of those in general freight trucking or specialized freight trucking

- 26% - Professional, scientific and technical services

- 13% - Construction industry

Earlier this year, the Canada Revenue Agency (CRA) and the Labour Program at Employment and Social Development Canada (ESDC) announced that they would be information sharing to ensure CRA receives information required for its compliance activities.

Unfortunately, Workers were Misinformed. It is unfortunate that many of the individuals involved may have been misinformed and now will have to come up with the money to pay back taxes. Consider the following findings from the Pilot:

- 63% of PSBs incorporated because they felt they were required to do so in order to find work.

- 29% indicated they were told to incorporate by their hiring company

- Of these, 42% were incorrectly informed that they were eligible for the SBD or general tax reduction

- 60% were told they could claim various operating expenses on their T2 Return.

- 84% had claimed the SBD, which they were not eligible for, and had not paid the additional 5% tax on PSB incom

e.

e.

EI Trap. Remember, too, that an incorporated employee who owns more than 40 percent of the PSB’s voting shares, will not qualify for EI (Employment Insurance), if the PSB doesn’t work out.

The Payer Has Tax Obligations Too. A payroll account must be opened by corporations that pay a PSB and a T4A, T4A-NR, T5018 or T1204, as the case may be, must be filed if all the conditions below exist:

- The payment was not made to one of the payer’s employees

- The individual, trust, partnership or corporation has provided a service for a fee

- The fee amount is actually paid by the corporation which received the service

- The payments were in the amount of at least $500 to an individual, a trust, a partnership or a corporation during the year, or tax was deducted from the payment.

Note that for Canadians residents, performing services inside or outside Canada, it is not necessary to make statutory deductions (withholdings for CPP, EI or income tax deductions) and it is also not necessary to include GST/HST and PST in the amount reported in box 48 of the T4A slip (fees for services provided).

The rules are different for non-residents. In this case, the payer must withhold and remit income tax on the payment for service at the rate of 15% and report the gross amount received on the T4A-NR slip as well as the income tax deducted (Boxes 18 and 22 respectively). Again, do not include GST/HST and PST, in this case in Box 18 or 22. There are no deductions for CPP and EI.

Construction workers. For those subcontractors whose primary source of business income is from construction activities, report the amounts paid on a T5018 in Box 22. What’s different, though, is the payer must include GST/HST and PST (where applicable) in this amount. Do not withhold CPP, EI or income taxes. A slip is not required if the worker supplies only goods but not services.

Bottom Line. Tax preparers who did not inform individuals with a PSB are well advised to contact clients to voluntarily comply to file corrections to returns to avoid penalties and interest.

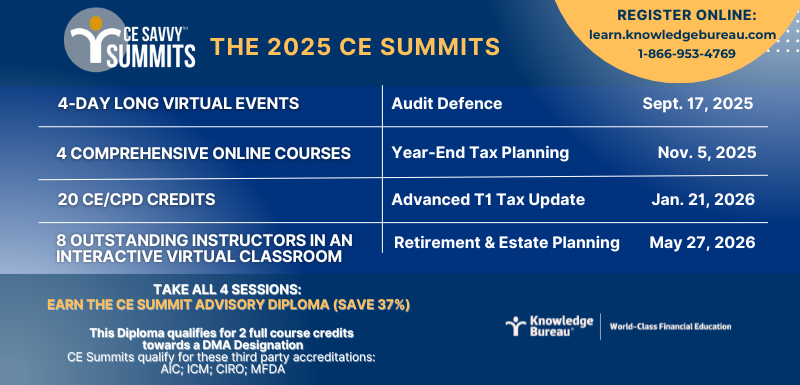

Additional Educational Resources: CE Summit Audit Defence