Auditor General Report Rips into CRA

Evelyn Jacks

CRA call centres received more than 10 million calls in the 2024-2025 fiscal year and deflected some 8.6 million of them! Further, responses to general individual-tax questions were accurate only 17% of the time, and wait times for speaking with an agent averaged about 31 minutes - twice as long as a year earlier. These are amongst the findings of the significant shortcomings articulated in the AG's report today. That's all pretty bad. But here's why it's also unacceptable.

The Backdrop. Taxpayers bear the burden of proof, and are responsible for penalties and interest costs when they are late or there are errors or omissions on their tax returns. The penalties are significant and the list is long; here excerpted from Knowledge Bureau’s Evergreen Explanatory Notes, which are provided as a resource to all Knowledge Bureau Students in the Specialized Credentials and CE Summit Programs.

- Failure to file a return on time: 5% of unpaid taxes plus 1% per month up to a maximum of 12 months from filing due date, which is June 15 for unincorporated small businesses S. 162(1)

- Subsequent failure to file on time within a 3-year period: 10% of unpaid taxes plus 2% per month to a maximum of 20 months from filing due date S. 162(2)

- Failure to provide information on a required form: $100 for each failure S. 162(5)

- Failure to provide Social Insurance Number: $100 for each failure unless the number is applied for within 15 days of the request S. 162(6)

- Failure to provide information with regard to a foreign-held property: $500 per month for a maximum of 24 months; $1,000 a month for a maximum of 24 months if there is a failure to respond to a demand to file plus an additional penalty of 5% of the value of the property transferred or loaned to a foreign trust or the cost of the foreign property where failure to file exceeds 24 months S. 162(10)

- Gross negligence: false statement or omission of information in the return: 50% of tax on understated income with a minimum $100 penalty. This penalty will also apply to a false statement relating to the GSTC. S. 163(2)

- False statements or omissions with regard to foreign properties: 5% of the fair market value of contributions made to the property, minimum of $24,000 S. 163(2.4)

- Late or insufficient instalments: 50% of interest payable exceeding $1,000 or 25% of interest payable if no instalments were made, whichever is greater. S. 163.1

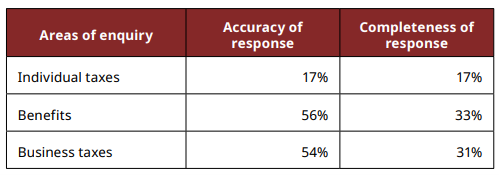

The Tax System is Complex. Help is clearly needed when one third of all Canada’s taxfilers are trying to reach CRA for answers. The wait times are a significant barrier to getting tax filings right. But so is the level of accuracy that is received. Seems like CRA itself is having trouble with the complexity. The Auditor General found:

- once connected to an agent, the average time spent speaking with the agent was approximately 17 minutes.

- about 27% of that time was spent on hold—either while the agent searched for information or transferred the call to another agent.

Was the outcome accurate? Not so much, especially in general inquiries about individual tax filings. Here is what the AG found:

The ideals of a self-assessment system is often discuss in relation to four factors: fairness, equity, simplicity and compliance. Taxfilers can’t comply when the tax system is not simple. Was CRA concerned about accuracy and completeness when taxfilers tried to get help with compliance?

Not according to the evaluation priorities in evaluating their staff. Only 9% of the total performance evaluation score of an agent was based on accuracy and completeness. The AG correctly observes:

“By not prioritizing accuracy and completeness in quality and performance evaluations, the agency placed greater emphasis on meeting resource management targets than providing complete, accurate, and clear information to Canadians.”

The Taxpayer Bill of Rights. The Taxpayer Bill of Rights enshrines certain standards that tax filers have in their relationship with the CRA. That’s very important because it is the foundation of a trusting relationship.

Taxpayers must be able to receive complete, accurate, timely, and understandable information about filing tax returns in their very complex, digital tax system to comply from their tax department. Further, they cannot be expected to wait unreasonable amounts of time in their busy days to try to get connected, only to receive inaccurate or incomplete information or to be deflected!

Here’s what the Bill of Rights says about that:

- “You can expect us to provide you with complete, accurate, and timely information in plain language explaining the laws and policies that apply to your situation. We have a wide variety of information available electronically, by telephone, and in print (generalized and specialized publications).

- Our enquiries agents have extensive training and reference tools that let them respond quickly and accurately to your questions and provide you with the highest quality of service.

- We offer our forms and publications in multiple formats for persons with a visual impairment.

- We use plain language and revise our publications to make sure that they are accurate and complete.

- If you feel the information you received from us was inadequate we want you to let us know. You can do so by using the CRA Service Complaint process. You have the right to lodge a service complaint and to be provided with an explanation of our findings.”

Unfortunately, this has not been recent experience with the CRA and the AG’s report perhaps is putting the agency on notice on behalf of all tax filers. But, taxpayers also put the complaints to the CRA and in significant numbers. From April 2021 to April 2025 complaints about CRA services increased by 145%, increasing required servicing costs even more! The number of complaints[1] were:

- 1673 - In the 2021–22 fiscal year

- 2721 - n the 2022–23 fiscal year

- 3290 - In the 2023–24 fiscal year

- 4104 - In the 2024–25 fiscal year

The Bottom Line: The 2025 tax filing deadline (Monday, April 30, 2026) is only six months away. CRA needs to make significant changes to its service levels in that time. And, in the meantime, it should automatically waive penalties and interest costs taxpayers are incurring when there are unreasonable delays or inaccuracies at their end. Further, it’s time to make tax accounting fees tax deductible, so that taxpayers who must pay to access their Taxpayer Rights to get the filings right, on time, at least get some tax relief for that.

What’s your take?

[1] Source: Based on data from the Canada Revenue Agency, from the Auditor General’s Report, October 21, 2025