Last updated: June 04 2025

Big Money: Help Canadians Get Their Uncashed Cheques

Geoff Currier

It’s a windfall worth billions! From time to time, we hear of a lottery ticket worth millions of dollars which has gone unclaimed. But CRA says it is sitting on some 10.2 million cheques, some of them dating back years. The total value amount is a staggering $1.7 billion, Blog TO reports. So why hasn’t the government been more proactive about getting this money in the hands of Canadians? Turns out an attempt was made. But there is more: a big opportunity for tax and financial advisors to help Canadians recover what is rightfully theirs and reinvest it for their future. Read on:

The Backdrop: In 2020 CRA launched a program to get that money into the hands of the Canadians who have it coming to them. Since the program was launched more than five years ago, some 4.5 million cheques with a total value of approximately $1.6 billion have been handed out. But there is more to go.

Some of these uncashed cheques go back as far as 1998. Since government cheques never expire your client can claim that money if their name is on it. In most cases these potential payments are worth less than $1,000 but 160 of them are worth six figures. This is particularly important for executors and financial guardians to the vulnerable.

Getting Your Client’s Cash: You can help your clients find out if any of those cheques have their names on them by getting them to log on to their CRA account. It’s the My Account portal. If your client hasn’t set up a My Account, you can guide them through the process. That’s really important as CRA focused on its goal of increasing digitized communications with Canadians.

There is a Form to File. In order to get a replacement cheque, a person will need to fill out a form called PWGSC 535. But you have to go through a lengthy and difficult process to get things started on the road to recovering the money. That’s of course, part of the problem with recovering the outstanding money from the government.

Once an agent has confirmed you have uncashed cheques, the CRA will send you a pre-filled form (Form PWGSC 535, Undertaking and Indemnity) for each cheque. Once you have received the pre-filled form from the CRA, someone needs to:

- Fill out the remaining fields

- Sign and date the form

- Enter your name and address under the signature

- Have a non-family member witness, sign and date the form

- Have the witness enter their name and address under the signature

If the form is not filled out correctly, CRA will send you a new form and explain the errors made. The form will need to be filled it out and resent. Imagine how frustrating this can be for your clients, shut-ins and executors.

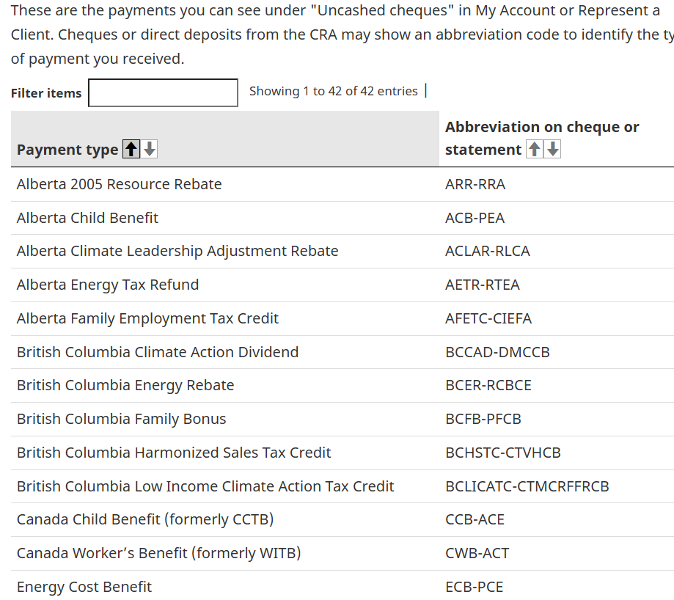

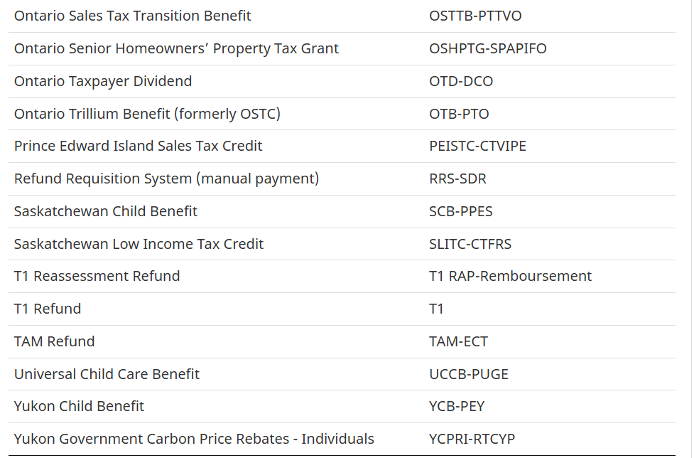

To get things started online, select "Uncashed cheques" on the My Account "Overview" page or the "Accounts and payments" page. You’ll be able to see a host of different payments to recover:

It goes on to show a total of 42 entries. You will find Personal cheques (tax refunds, most credits and benefit payments), including cheques issued to a deceased person, and in particular those that are more than 6 months old.

Old School – When to Use the Phone. You cannot use the online option in the following cases: when you are trying to recover Business cheques (corporate tax, business GST/HST or payroll), Trust cheques, cheques less than 6 months old and any cheques unavailable in My Account or Represent a Client.

Here are the phone numbers: For personal income tax refunds or payments made to a trust: 1-800-959-8281. In the Yukon, Northwest Territories and Nunavut: 1-866-426-1527. For those outside Canada and U.S. (operates in Eastern Time): 613-940-8495.

To recover cheques for credit and benefit payments for individuals, including COVID-19 benefit payments: 1-800-387-1193.

For business tax and credits, GST/HST, and payroll, including COVID-19 business subsidy payments, call 1-800-959-5525. In the Yukon, Northwest Territories and Nunavut the number is

1-866-841-1876. Outside Canada and U.S. (operates in Eastern Time): 1-613-940-8497

A Possible Debate: This scenario raises a couple of interesting questions, though. First, why does the government make this so difficult and time consuming?

Second, how long should the government sit on unclaimed cash before simply returning it to general revenues? Should there be a time limit-a statute of limitations?

An argument can be made that many of these cheques are benefit payments and that the people to whom the money is owed are the people who need it the most. The counterargument is that if they haven’t bothered to cash the cheque or apply for a replacement after losing it, they may not want or need the money. Some may have died.

It’s possible that some cheques were issued in the names of people who were already deceased rendering those people ineligible to collect. Some may have moved and CRA has been unable to track them down to let them know they have money waiting for them.

It can further be argued that given our government’s current fiscal condition that returning some of this money to government coffers after a certain period of time would be the prudent thing to do, rather than spending time and resources chasing down people who didn’t care enough in the first place to claim their cash. Even by federal government standards, $1.7 billion is not small change.

The Bottom Line: Nevertheless, you may wish to inform your clients that some of that unclaimed money could well be theirs. You can be of service to your clients by notifying all of them of the situation and encouraging them to go into their My Account just to make sure they aren’t leaving money on the table.

You can advise your clients to set up direct deposits for their online banking to ensure they receive money to which they are entitled. That way, they remove the possibility of a cheque which is lost, misplaced or delivered to an incorrect address.

Stay tuned weekly to Knowledge Bureau Report for continuing coverage of breaking tax and economic news and tune in to a new podcast- Real Tax News You Can Use with Evelyn Jacks: podcast@knowledgebureaureport.com