Building Wealth for Retirement: What’s the Right Choice?

The Registered vs Non-Registered Savings Calculator let you see at a glance how your saving will accumulate over time based on your current savings balance and your plan for periodic deposits. The calculator shows the results in a non-registered savings account as well as in a registered savings account such as an RRSP or TFSA as well as the future value of the accumulated deposits.

Example

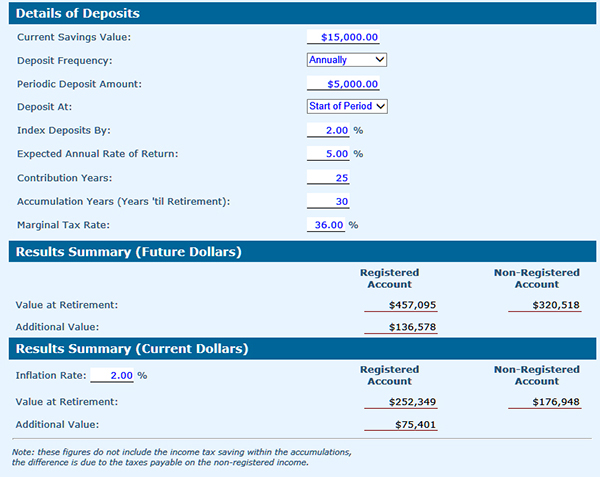

Kimberley is 35. She currently has $15,000 in her TFSA and plans on making $5,000 per year deposits to the TFSA each January until age 60 (25 years). She plans to index her deposits annually by 2% and projects to earn an average of 5% return on her investments. Kimberley expects her average tax rate to be about 36% over the next 30 years and inflation to run at 2%. She wants to know how much this plan will generate by the time she’s 65.

With these numbers entered into the calculator, we see:

When Kimberley turns 65, her TFSA will have grown to $457,095 ($136,578 more than if she had put the funds in a non-registered account because of the taxes payable on the earnings each year).

Taking into account inflation, the purchasing power of these funds will be $252,349. Since the TFSA withdrawals will not be taxed, the $250,000 may be sufficient to fund a modest retirement when added to her expected OAS and CPP pensions.

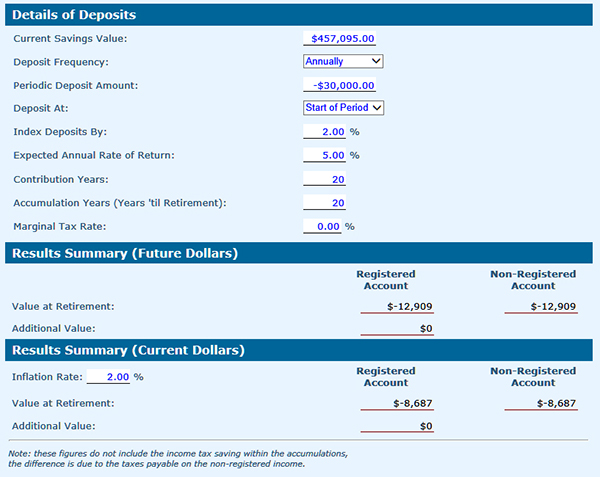

The calculator can also be used to look at the depletion of savings over retirement. If Kimberley wanted to have $30,000 per year (starting at age 65), indexed for inflation at 2% over a 20 year retirement, the plan just falls short.

Starting with the $457,095 TFSA balance and withdrawing $30,000 a year (indexed) for 20 years would leave a balance of -$12,909 – i.e. she’ll run out of cash in the final year of her retirement.