Calculate If That New Job is Right for You

The Take Home Pay Calculator provides quick answers to aid in decisions about taking a new job in a different province or changing withholdings by adjusting your TD1 or filing Form T1213.

Scenario 1 – Justin's New Job

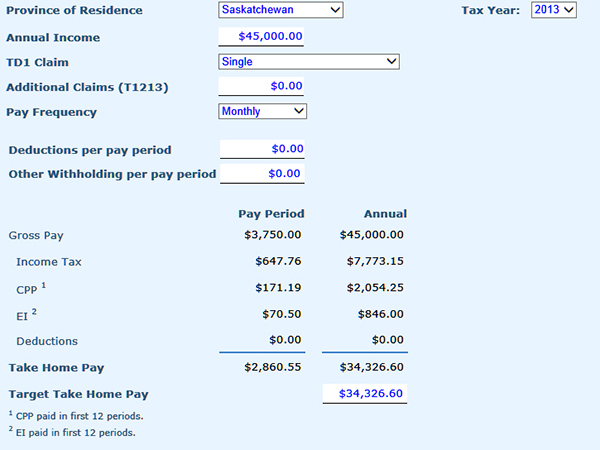

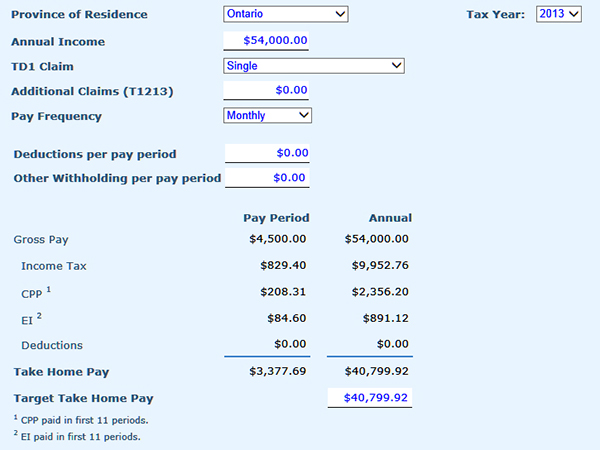

Justin currently works in Saskatchewan earning $45,000 annually. He has no source deductions other than his own basic personal amount. He is paid monthly and takes home $2,860 per month. He has been offered another position – in Toronto – that pays $54,000. Based on cost of living differences between Saskatchewan and Toronto, Justin feels he needs at least $500 more per month just to make ends meet. Will the new job provide that for him after taxes?

Based on the calculator, Justin currently takes home $2,860.55 per month.

Switching the province to Ontario and the salary to $54,000, we see that Justin’s take home pay increases to $3,377.69 – an increase of $517 per month. On the basis of cash flow alone, he will be marginally ahead by taking the new job.

Scenario 2 – Muriel's T1213

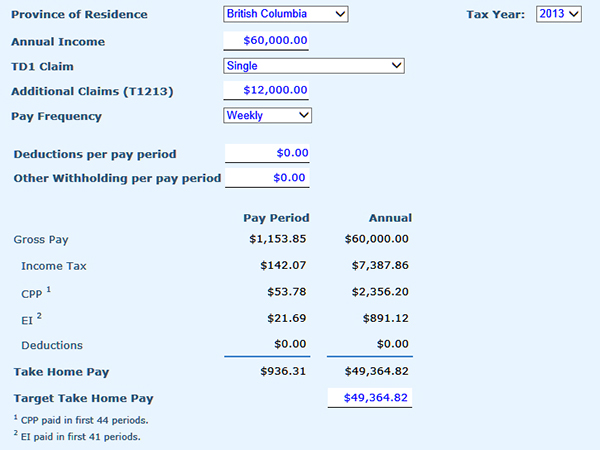

Muriel lives in BC. She earns $60,000 annually and each February contributes $12,000 to her RRSP. Her advisor has convinced her that contributing $1,000 per month would be both easier to manage and generate better results. Currently her take home pay is $867.77 per week. How would claiming the $12,000 deduction on Form T1213 affect her take home pay? The calculator shows that it would increase to $936.31 per week – an increase of $68.54. This would provide and extra $274.16 every month to help fund the monthly RRSP contributions.

Scenario 3 – Andre's Target Pay

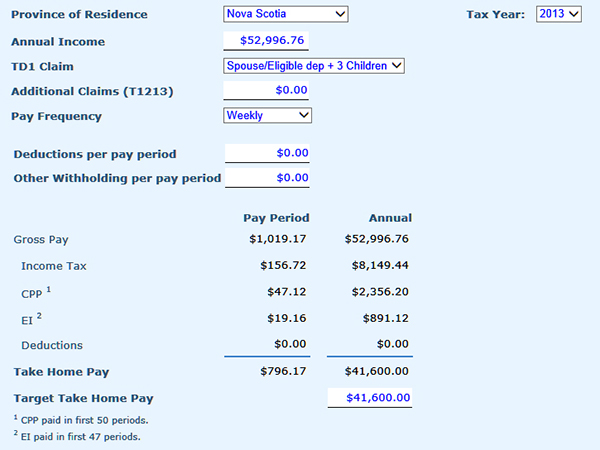

Andre has just moved to Halifax and has determined that he needs $800 per week minimum to live in the city with his family – that’s $41,600 per year. With a non-working spouse and three small children, how much salary does he need to take home $800 per week? By using the Target Take Home Pay field, the calculator shows he needs to earn at least $52,996.76 annually or $1,019.17 per week.

The Take Home Pay Calculator is one tool in the Knowledge Bureau Toolkit. Use it to explore scenarios regarding new jobs, minimum salary requirements, or the effect of adjustments to TD1 or T1213 claims will have on income after withholdings.