Do Seniors Pay Too Much Tax?

Geoff Currier and Evelyn Jacks

Important news for tax and financial advisors: the over 65 demographic may not be as affluent as some might think; yet they still pay a lot of income tax. Canadian seniors sent just over $58 billion to the government in the form of income taxes in 2023, the last year for which statistics are available. It works out to an average of more than $12,000 per person. It leaves the average after tax income for those over 65 in Canada at just over $45,000.

This relatively low number might shock some and begs for professional planning, particularly if inflation weary, cash-strapped seniors are sending too much to Ottawa by way of quarterly remittances.

It might come as a further surprise the amount of debt Canadian seniors carry. The average Canadian over age 65 still has a mortgage of just over $85,000 and consumer debt of more than $42,000. It becomes apparent why so many continue to work beyond their 65th birthday. For many it is a necessity.

Debt reduction is a significant challenge given the high rate at which Canadians are taxed but there are a few options available to help your clients navigate this time of their lives, and your help can be invaluable, especially in a digital world in which the relationship with CRA is increasingly mystifying for most people. That in fact, may be a great conversation opener, now that the September 15 tax instalment remittance deadline has passed.

Help with Digitization. If you are using tax software, it’s easy to assemble a list of clients who may appreciate a check-in call from you: those who owed a balance to CRA at tax filing time, and those who are quarterly tax instalment remitters. Let them know you are ready to help if there are any cash flow issues, or, given CRA’s push to digitization, whether your clients are staying on top of CRA communications.

Pension Income Splitting. There are several ways for senior couples to reduce their taxable income and instalment remittances with pension income splitting opportunities. For couples, sharing the public CPP benefits is an option if both have reached age 60. Many people don’t know about this.

Pension income splitting of private pension savings is another tool; the age eligibility depends on whether the pension is employer-funded, or comes from an RRSP (recipient must be age 65). Be sure to contact any taxpayers who are reaching age 60 to 65 this year for a planning session. Provide “what if scenarios” that may help them to better manage cash flows with better after-tax results. They may not have to withdraw as much from savings with tax optimization.

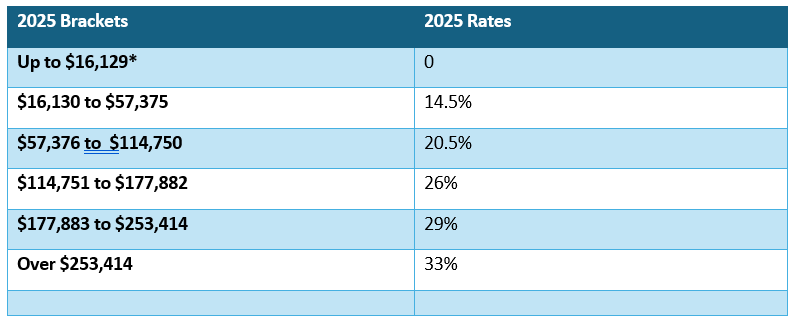

Or, it’s possible they should be withdrawing more, to “top up to bracket”, as a way to reduce overall taxes during their retirement. Review the tax brackets for 2025 with your clients:

Federal income tax rates for 2025:

*Note that the Basic Personal amount for those whose taxable income is subject to the 33% rate is $14,538. When net income is greater than the amount at which the 29% tax bracket begins ($177,883 for 2025), the BPA gradually phases out by up to $1591 to a minimum of $14,538.

Therefore, a senior household can have a taxable income of $114,750 in total ($57,375 x 2) and have income taxed at the lowest federal tax rate (14.5%) with proper planning using pension income splitting opportunities. There may be an erosion of the age amount ($9028 per person) if net income is over $45, 522. It may be possible to work around this.

RRSP Options. This is where the RRSP comes in. If the taxpayer is under age 72, an RRSP can reduce net and taxable income and enhance accessibility to tax credits as well. When it comes to income splitting, planning ideally starts at a younger age – and unless there is, no qualifying earned income, it may not be too late for seniors to take advantage.

For example, some of your clients may not be aware of the spousal RRSP, which allows the higher earning spouse to contribute to the lower earner’s RRSP if they are age eligible; thereby offering some planning options later in life.

The lower-earning spouse may wish to draw their own RRSP benefits earlier than age 65 for example. But there are, of course, some withdrawal restrictions: if the funds contributed to a spousal RRSP are withdrawn within three years of contribution, the higher earning contributor must report the withdrawal. An exception is possible when an RRSP is converted to a RRIF – only amounts over the minimum withdrawal are attributed to the higher earning contributor in that case.

While some may correctly think an RRSP is just deferred taxation, it matters more when seniors have higher medical or dental costs (see below). Correctly planned to have a family net income under $90,000, seniors may qualify for the Canada Dental Care Plan.

Medical Expenses and Disability Tax Credits. In conversation with your clients, always be sure you ask about their state of health. Medical expenses are amongst the most missed provisions on the tax return. Some common examples are prescription drugs, glasses, contact lenses, hearing aids and their batteries, travel insurance such as Blue Cross, ambulance services and in some cases, attendant care. CRA has a great list online to review with your clients, which they will appreciate.

All of this matters, as the average out-of-pocket medical cost in Canada is rising. A recent 2025 study[1] notes:

- 29% of Canadians paid over $1000 out of pocket in the past 12 months for health or dental-related services, and 9% paid over $3000.

- Those aged 55+ spent the most of any age group on out-of-pocket expenses, averaging $1,321 in annual spending, compared to only $686 for ages 18-34.

- The most common expenses? 60% of Canadians paid out-of-pocket for dental care in the past, followed by prescription drugs (55%) and vision care (54%).

These amounts qualify for tax relief, and as discussed above, with proper planning, further tax relief may be possible under the Canada Dental Care Plan.

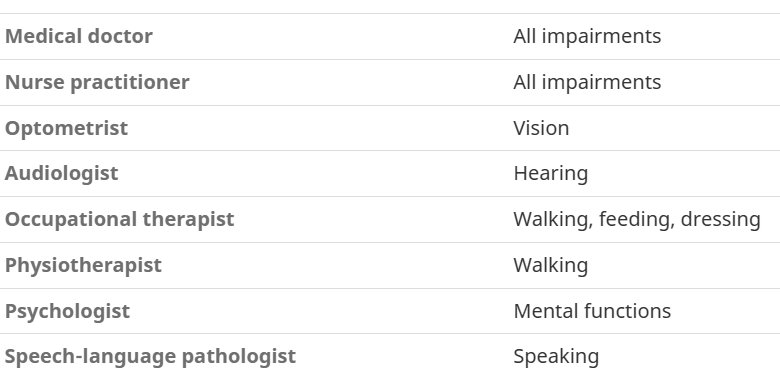

The Disability Tax Credit (DTC) can also be of enormous benefit, especially to those at the lower end of the income spectrum. Remember, if they were eligible for the DTC in past years but did not claim it, they can go back as far as ten years. The amounts have increased from $7,899 in 2015 to $ $10,138 in 2025. There are additional supplements for children under 18 for the purposes of claiming their DTC. This situation may arise if your client has a progressive disability such as a breathing issue, advancing cancer or dementia. There is much more information on the DTC in the September 3rd edition of the Knowledge Bureau Report and it’s important to take a close look at new form T2201, the Disability Tax Credit Certificate. This must be signed by a medical practitioner, and the role of that professional may be different, as per CRA:

Fees that may need to be paid also qualify as a medical expense.

[1] These findings are from a survey conducted by PolicyMe from May 9th to May 12th, 2025, among a representative sample of 1502 online Canadians who are members of the Angus Reid Forum.

The Bottom Line: In spite of all of the so-called “tax breaks” that seniors receive, many of our older fellow Canadians struggle to make ends meet and live a comfortable life in their retirement years, often simply because they can’t navigate our complex tax system.

You can be the difference. As always, it’s important for you to remember that you are not just in the numbers business. You are in the people business, and when you are able to assist those beyond age 65 to understand the changes they face in how their finances and taxes are managed as they age, your work can become even more rewarding.

Additional Resources for your education: