Late Filers Give Up Millions

Geoff Currier & Evelyn Jacks

Tax professions know that not every client will file their income taxes on time, and that’s a costly mistake. Did you know that each year over three million Canadians file past the deadline? Those late filers are losing big money. First if they are due a refund, they are losing out on the money that could be accruing in a TFSA, RRSP, FHSA or another tax savings account. But there is a second, more expensive consequence, one that will increase in the future, too.

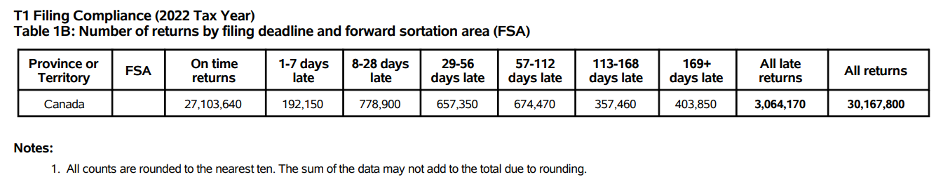

How Late is Late? Statistics Canada released data in February 2024 about late filing trends for the most recent year reviewed, 2022. Here’s what they found:

The Cost of Filing Late: When taxpayers owe CRA money, they are going to be charged interest. But there are also penalties. The first time someone files late the penalty is 5% of the amount owed plus an additional 1% for each month the payment isn’t received up to 12 months. That should be plenty of incentive to file on time.

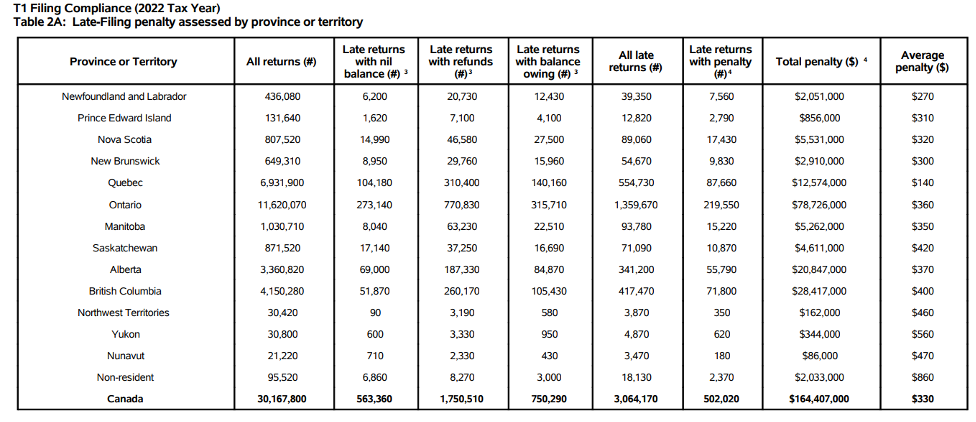

But, if your client has been late a second time, that penalty rises to 10% of the amount owed plus 2% for each additional month up to 20 months. And the amounts really do add up. Here are some stats, again for the 2022 tax filing year. While the average penalty for Canadians is $330; the sum is over $164 Million. Northern residents and non-residents appear to pay the most:

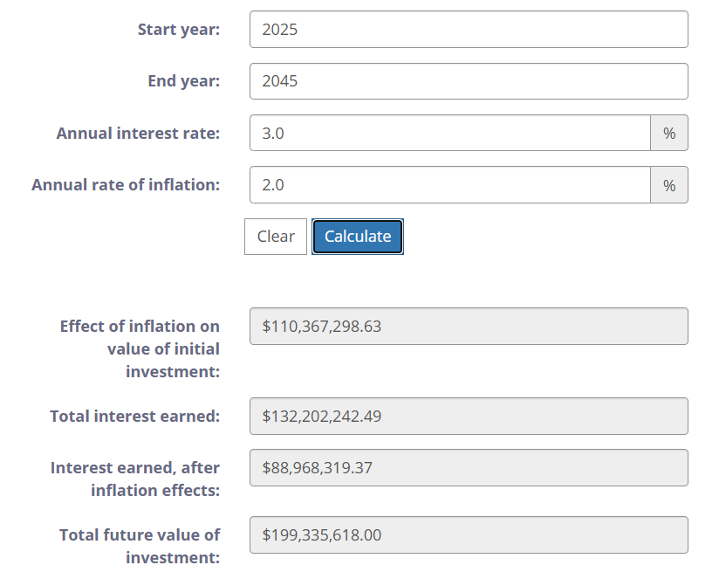

Imagine investing this $164 Million at a compounding rate of 3% instead. Canadians are giving up over $132 Million in interest. That buys a lot of groceries even after inflation, according to this Bank of Canada calculator:

A Lucrative Revenue Boost for Government. Meanwhile it’s important to be aware that the new Liberal government has stated in its election platform that it intends to raise $1.750 Billion by raising penalties and interest in the future. It’s therefore critical that your clients understand the need to file on time if at all possible.

But there is another reason to comply: Aside from the penalties and interest, CRA has more extensive powers. It can garnish wages or seize assets when taxpayers don’t file and are found to owe money. Jail time is rare but in the case of deliberate tax cheats it’s a weapon CRA has in its arsenal. The offence must be egregious, but the tool is available to CRA.

A Further Cash Flow Drag. A third and important reason to file on time is that some benefits your client may be owed could be disrupted if they file late including the GST/HST credit, the Canada Child Benefit and Old Age Security. That effects cash flow – another important hedge against inflation at the pumps, the grocery store and other taxes, like property taxes, for .png) example.

example.

Changes to Filing Dates: Because of the confusion regarding capital gains changes announced in 2024 (which were subsequently reversed in January of 2025), CRA has extended the tax filing deadline for those affected. CRA tells us “The CRA will grant relief in respect of late-filing penalties and arrears interest until June 2, 2025, for impacted T1 Individual filers and until May 1, 2025, for impacted T3 Trust filers to provide additional time for taxpayers reporting capital dispositions to meet their tax filing obligations.” However this relief does not extend to spouses.

Business owners have until June 16 to file this year. But in this case, balances due should be computed by April 30, because the interest clock starts ticking May 1.

If there is a Death: If your client is filing on behalf of someone who has died, there are deadlines that must be observed. If the death occurred between January 1 and October 31, the final return is due on April 30 of the following year. If the death occurred between November 1 and December 31, the final return is due 6 months following death.

A link to more information from CRA appears at the end of this article.

Phoenix Payroll: If your client was impacted by the Phoenix Payroll System in tax years 2016 to 2020, there are tax implications for them. They likely received a lump sum and the portion for stress and damages up to $1500 was considered to be non-taxable. To receive this, a Notice of Objection had to be filed to dispute the full taxation of the payment. Unfortunately the deadline for this has passed: it was April 30, 2024. Nonetheless, look for those lump sums and be sure to exclude the eligible amount from income.

CRA has the information you’ll require. But be warned it is a quagmire and it is worth revisiting to be sure income was not double reported. As an example, for the 2020 year, if the taxpayer only received emergency salary advances/priority payments, they are reported on the 2020 T4. But if the taxpayer also started receiving payments from Phoenix in 2020, only the Phoenix payments, not the salary advances/priority payments, are reported on the 2020 T4.

The Bottom Line: If you have a client who has not filed on time, or has outstanding issues from prior filed returns, you can still help them avoid further penalties by encouraging them to file as soon as possible.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/interest-penalties/late-filing-penalty.html

Stay tuned weekly to Knowledge Bureau Report for continuing coverage of breaking tax and economic news and tune in to a new podcast- Real Tax News You Can Use with Evelyn Jacks: podcast@knowledgebureaureport.com

A Recession-Proof Career, 2025-2026 DMA Program now available! Check out a special tuition offer now, start dates May 1 to June 15.