Freedom Never? Generation X and Retirement

Geoff Currier and Evelyn Jacks

Those born in the years after the Second World War were given a generational name: the Baby Boomers. Now most are fully immersed into retirement, and their retirement readiness factors are playing out in inflationary times with significant market volatility. Subsequent generations have also been handed monikers, whether they asked for one or not: those born between 1965 and 1980 have been tabbed Generation X and for them, retirement planning is (or should be) in full focus. Here’s why: they are between their 40’s and 60’s and indications are many are ill prepared for retirement.

The Backdrop: Back in 2016 poll of more than 2,200 Canadians over 18 conducted by RBC revealed that 58% were concerned they would run out of money if they live to 100 but more concerning was the finding that 31% had not begun saving for retirement. It’s one thing to have no retirement savings at age 20. It’s quite another at 45.

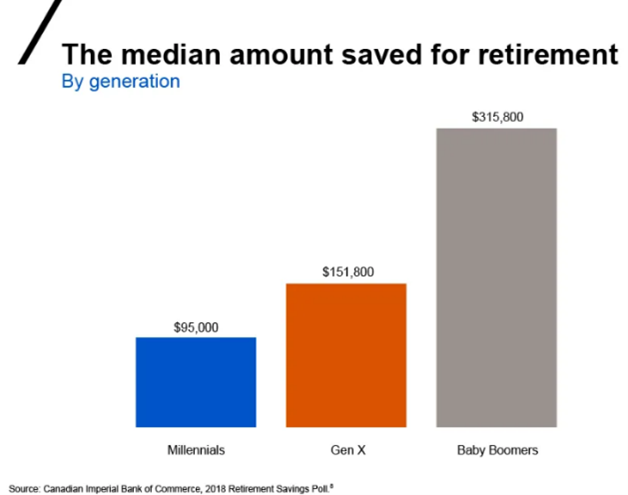

Fast forward to 2018. The median amount saved was only $151,800 at age 55; about half of what the Baby Boomers had accumulated as they started their retirements.

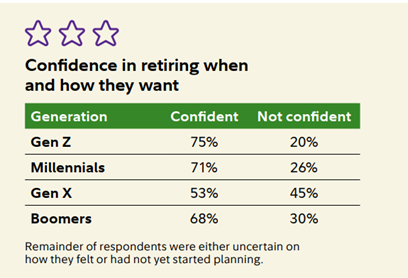

The same trend appears to be true in the U.S. According to a 2025 survey by Fidelity Investments only 53% of Gen Xers southside are confident they'll be able to retire when and how they want to, compared with 75% of Gen Zs, 71% of Millennials, and 68% of Baby Boomers.

Understand the Why? Your Gen X clients have several factors working against them. They experienced both a recession in 2008-09 and Covid 19 during their peak earning years. They are also in an era in which defined contribution pension plans have become the norm as opposed to defined benefit plans and that’s assuming they even have a pension plan at all. And they are the “sandwich generation” – looking after both children and aging parents in an inflationary period of time.

In addition, Gen X’ers are the first of the plastic money people. Debt mounts and with it the hefty interest charges on credit cards.

One of the contrasts between Boomers and X’ers is the approach to work. Boomers were devoted to their work and their careers. Gen X’ers have more often valued work-life balance. Unlike Boomers, who were raised by those who may have endured the Great Depression and placed enormous emphasis on saving, X’ers were raised in relative prosperity. Saving for a rainy day holds less appeal.

All have conspired against Generation X. . . nonetheless, GenX’ers have not saved enough. Your clients require direction to comprehend what lies ahead.

Getting Back on the Saving Track: While, many of these factors are out of the control of your clients, it is critical to focus on what is in their control. This includes the need to take retirement planning into their own hands. They can expect to live longer than previous generations and so will need a larger nest egg to live comfortably in those extra years. You can therefore encourage them to contribute as much as they are able to RRSP’s or TFSA’s.

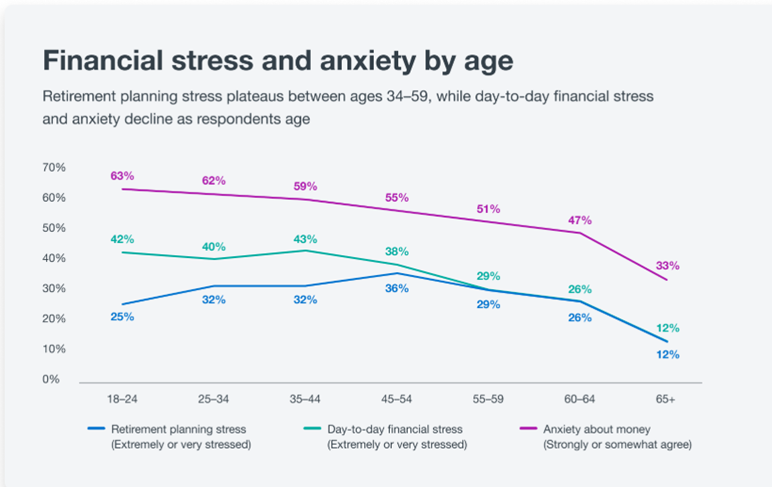

Your Role: It cannot be stressed enough to your clients who are between 45 and 60, the importance of maximizing their retirement savings while in their peak earning years. If they failed to save in their 20’s and 30’s they are well behind where they’ll need to be for a comfortable retirement. This is where you can be of great assistance. Laying out an aggressive yet sensible savings plan can help ease the anxiety of facing senior years without enough income.

Money placed into an RRSP reduces taxable income, generates tax refunds and this can trigger additional savings into a TFSA.It’s possible some of your clients have never taken a serious look at those numbers and how they quickly project out to retirement savings accumulations. This is important work.

Financial Stress is a Reality. CPP Investments revealed in a study last November on just how prevalent financial stress is in society today, especially for Gen X as it relates to their retirement:

The Bottom Line: Living longer on less money than their parents is not an appealing prospect. Working in this generation’s favour, though, is that they will probably be healthy enough to work past age 65 and keep earning and saving. They may also benefit from the wealth their Boomer parents accumulated when it is passed down to them. Ultimately, though, the more control your clients have over their own future, the better for both their material and mental well being.

You can help steer them towards a better life. It may be late for Gen X but it’s never too late.

Additional Educational Resources:

Knowledge Bureau Network: Stay tuned weekly to Knowledge Bureau Report for continuing coverage of breaking tax and economic news and tune in to a new podcast- Real Tax News You Can Use with Evelyn Jacks: podcast@knowledgebureaureport.com