Navigating Auto Expense Deduction at Year End: What Clients Need to Know

Geoff Currier

Doubtless you’ve had clients ask whether they can write off any portion of their vehicle for work or business purposes. And your answer, as always, is: “It depends.” The rules are worth reviewing at year end as they can vary significantly depending on how the client earns their income—employee, self-employed, or incorporated – and this is a deduction that’s often audited. Here’s a practical primer to guide that conversation.

Employees: Strict Rules and Required Forms. Salaried employees can deduct auto expenses only when all of the following criteria are met:

- They are required to work away from their employer’s place of business.

- They do not receive a vehicle allowance.

- They retain proper records and a signed Form T2200, Declaration of Conditions of Employment is on hand (electronic signatures are now allowed). The T2200 is not filed with the tax return but must be kept on file.

- Company Vehicles: If clients use an employer-provided vehicle for personal use, they will incur a taxable benefit on their T4 Slip. Help them understand how it’s calculated to avoid surprises and to discuss whether it’s best, from an after-tax point of view, for the employer to own or lease a vehicle, especially if your client is an employee and a shareholder of the company.

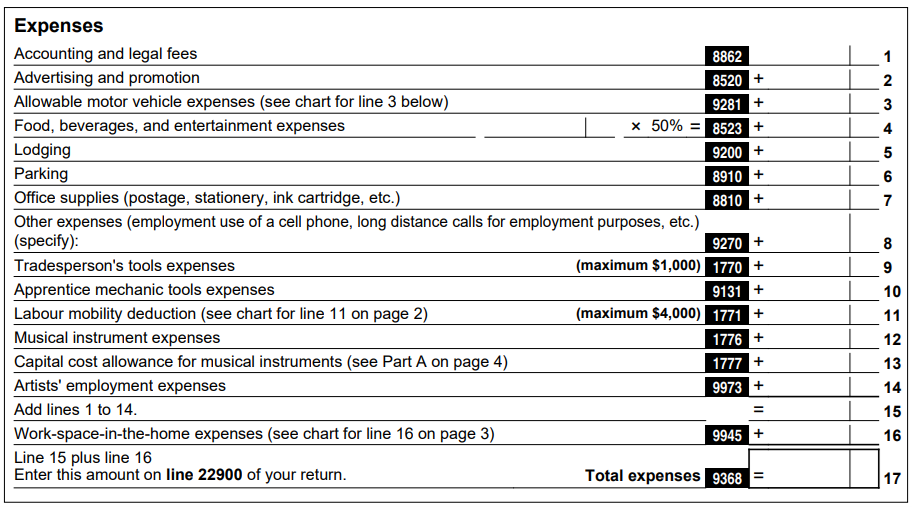

- The employee must also complete Form T777, Statement of Employment Expenses with the tax return. This is an important form to discuss with the client and becomes a great checklist for the actual receipting that’s required. Here’s a sampling:

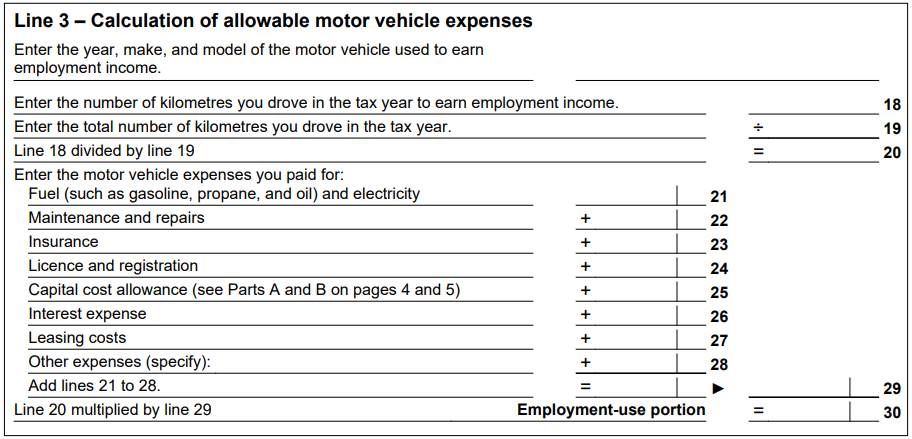

Rules differ slightly for commissioned salespeople or transport employees (who require Form TL2). Remind clients to retain every vehicle-related receipt. A detailed logbook is critical. CRA audits vehicle expenses frequently, and you must calculate the percentage of work-related use against total annual mileage. You’ll note that’s required to fill in the form below:

Common deductible expenses include fuel, insurance, licensing, loan interest, leasing, parking, and Capital Cost Allowance (CCA). But there are fixed costs, subject to annual maximums for the costs of capital cost allowance, interest and leasing costs. For 2025 they are as follows:

- Max CCA cost: $38,000 + tax

- Zero-emission vehicles: $61,000 + tax

- Max lease deduction: $1,100/month + tax

- Max interest deduction: $350/month

Speak Their Language: Define the Tax Terms. Clients won’t always understand tax jargon. Take time to explain tax terms like

- Auto Log Requirements

- Fixed vs. Operating Costs

- Capital Cost and Capital Cost Allowance

- Depreciable Property and Depreciation

- Fair Market Value

- Non-Arm’s Length Transactions

- Proceeds of Disposition

- Undepreciated Capital Cost (UCC)

The Bottom Line: Plan Before Year-End. Clients often rush to purchase vehicles at year-end for a bigger CCA write-off. You can add tremendous value by proactively reviewing auto tax implications before they buy—and educating them on log keeping and documentation.

For more in-depth guidance, subscribe to Evergreen Explanatory Notes and equip clients with checklists that make their documentation audit-ready.