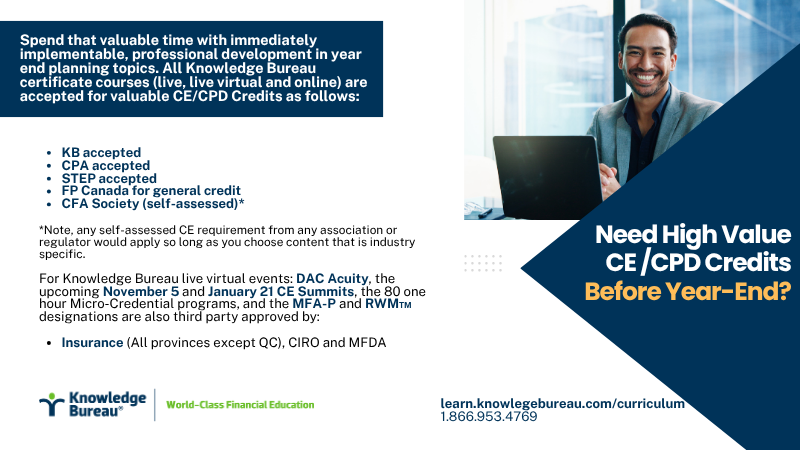

Need High Value CE/CPD Credits Before Year-End?

Spend your valuable time with immediately implementable, professional development in year-end planning topics. Did you know that all Knowledge Bureau certificate courses (live, live virtual and online) are accepted for valuable CE/CPD Credits? Details follow. Plus, we have a DMA Designation Program offer, it’s so good – it’s scary!. Check it out:

KB Courses are accepted by:

- KB accepted

- CPA accepted

- STEP accepted

- FP Canada for general credit

- CFA Society (self-assessed)*

*Note, any self-assessed CE requirement from any association or regulator would apply so long as you choose content that is industry specific.

For Knowledge Bureau live virtual events: DAC Acuity, the upcoming November 5 and January 21 CE Summits, the 80 one hour Micro-Credential programs, and the MFA-P and RWM™ designations are also third party approved by:

- Insurance (All provinces except QC), CIRO and MFDA

DMA Program Halloween Offer

From now until October 31, enrol in a DMA Designation Program of your choice, and save an additional $200 already low program tuition fees (only $562 per course). Use code: 25OCTDMA when you enrol!

Looking to Upskill Your Team or Start Your Own Practice?

Build a Professional Career in Tax, Accounting & Financial Services with Specialized Credentials: With a clear technical foundation, you and your team can deliver advice that’s defensible, strategic, and aligned with real client needs.

Develop a rewarding career path with the DMA Specialized Credentials Program — and stand out as a trusted expert in today’s competitive financial services landscape.

Specializations:

- Personal Tax Services Specialist

- Corporate Tax Services Specialist

- Accounting Services Specialist

- Small Business Services Specialist

Course Components:

6-30 hour certificate courses, 30 CE/CPD Credits per component.

Did You Know Your KB Education May Also Qualify Tuition Credits?

Here’s how that looks when you take the Distinguished Master Advisor Program.

Tuition Fees: $3,370.00

plus GST (5%)*: $3,538.50

*assuming a 5% GST for this example.

CTC Calculation: $1,250

(Calculated as 50% of tuition, capped at $1,250 for 2025.)

If no taxes are payable, the amount is fully refundable when you file your tax return.

Claim for Remaining Amount

Tuition Credit:

Tuition amount less CTC claimed = $3,538.50 – $1,250 = $2,288.50

(T2202 required)

Tax Benefit:

15%* × $2,288.50 = $343.28

* provinces may vary

Total Tax Benefit:

CTC + Tuition Tax Credit = $1,250 + $343.28 = $1,593.28

Net Cost of Tuition (After Credits):

$3,538.50 – $1,593.28 = $1,945.22

Everything is Included in Your Tax Deductible Tuition Fees!

- Personal Consultation and Orientation

- Comprehensive Knowledge Journal

- Tax Tip Toolkit (EverGreen and RWM™ Calculators)

- Lesson Plans & Study Plans

- Comprehensive Knowledge Journal

- Tax Tip Toolkit (EverGreen and RWM™ Calculators) Lesson Plans & Study Plans

- Testing & Certification, CE/CPD Accreditation

- Personal Instructor Support

Get started before October 31: enrol online at learn.knowledgebureau.com/courses or 1.866.953.4769