Last updated: January 28 2026

Preparing Clients for Tax Season

Evelyn Jacks

Tax season 2026 has officially started with the release of the 2025 T1 return on CRA’s web pages. There are over 60 pages that belong to the T1, including accompanying schedules, but in addition, it is possible that one or more of hundreds of auxiliary tax forms may be required. There is a lot to know, as the Burden of Proof is always on the taxpayer, and the rigor of professional knowledge required to be in public practice continues to grow exponentially. Against that backdrop, what is the best way to prepare clients this month, for what is to come as we speed towards April 30?

The Objectives. It is critical to identify the multiple stakeholders to an optimal tax filing result. Your role is to identify the individual taxpayer and all the household members required to meet your accountable results in a referrable tax practice; specifically to prepare:

1. A mathematically accurate return, which includes all of the income of the year, or prior years in the case of special provisions such as the capital gains reserve.

Software in general has accurate tax calculations approved by CRA. But there have been lots of mistakes due to digitization issues at the CRA which can impact the accuracy of filings. This can be as simple as the accuracy of T slip filings - CRA may have different records, for example, which could generate penalties and interest and a host of online communications to get things straightened out.

Also, it is possible to file a return mathematically correctly, numerous different ways. But the object of a professional’s work, is to file tax returns for a household unit that results in the very best after tax results and benefits, available under the intent, object and spirit of the law. That means that only the correct amount of tax is paid this year and in carry over years, and the correct amount of social benefits, refundable and non-refundable tax credits are claimed.

Strong communications and document gathering in January and February will help achieve those optimal results.

2. A theoretically correct return, which includes all the tax deductions and credits a household is entitled to, including off-return provisions that are income-tested, such as pharmacare deductibles, the Canada Dental Care Plan and the Canada Disability Benefit.

The Tax Fact – This Year and 10 Prior Years – 2016 to 2025. In particular, review capital gains reported in the prior three years. They can be offset by unused capital losses carried forward from 1972. Did the client miss calculating losses in any tax year since 2016? If so, adjust the return.

A tax return filed to the best benefit of the household, optimizing allowable transfers between family members, optional deductions such as Capital Cost Allowances, and carry over provisions. This begins with a standard question: What has changed since the last tax filing? Categorize the life events that will affect this year’s tax return, and what provisions on the return must be addressed as a result.

- Life events: births, deaths, marriages, separation and divorces, the onset of disability

- Financial events: new homes, new jobs, job termination or retirement, sale of a business, bankruptcy, the start of public or private pension plans, the receipt of an inheritance, new debt, paid off debt, refinanced debt, investment losses, business losses.

- Economic events: interest rate fluctuations, inflation, recession, tax change, market volatility – events that cause your clients to want or need to make decisions about their finances

Pro Tax Tip – Be sure to get the birthdates right, and Identify any tax balances due ASAP. Prescribed interest rates charged on balances due to CRA have come down from a high of 10% on outstanding balances starting January 1, 2024, to 8% for the first two quarters of 2025 and 7% for the last two. See Carrying Charges below.

Prepare Returns for the Whole Family. Filing a tax return is the first step in filing correct returns, receiving tax refunds and benefits, as well as tax efficient investment, retirement and estate planning. Consider net family income levels (and clawback thresholds) for income-tested benefit calculations. These benefits are often a mystery to clients, as CRA often does not identify the source when depositing the money – or asking for it back if paid in error.

Pro Tax Tip. The family net income is critical in planning to receive more in generous refundable tax credits and avoiding high marginal tax rates when benefits are clawed back as income rises. This is often confusing for clients and affects tax-efficient investment planning.

Prepare a net worth statement for each family member. This is the best way to determine gaps in tax planning opportunities with RRSPs, FHSAs, TFSAs, RESPs, RDSPs, etc. When it comes to non-registered accounts and non-financial assets, discuss tax consequences of acquisitions and dispositions to occur in 2026: changes in principal residences, vacation properties abroad (update and complete T1135 Foreign Income Verification Statement if there is 51% or more rental use), cottages and businesses.

Bottom Line: Experienced professionals always start the new tax filing season with a complete pre-filing review to uncover errors and omissions from prior filed returns – for each member of the family. Due to new complexities in tax law every year, this will require more time in certain cases: for clients with asset dispositions or new tax calculations under the Alternative Minimum Tax, for example.

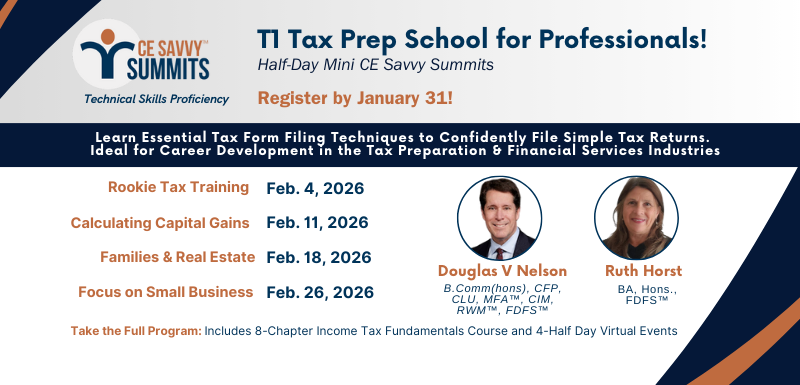

Prepare for the upcoming tax season with KB's T1 Tax Prep School