Last updated: January 28 2026

Pros Required: Unwise to Dabble in Tax Preparation

Why is professional tax preparation growing in Canada? Taxes and lives are changing constantly, and the shift to a fully digital tax system now requires a full-time commitment to get it right. Errors can cost taxpayers thousands, and the entire relationship with the CRA matters. In 2024–2025, the CRA processed more than 33.2 million individual tax returns, and reported a 47% increase in objections over the previous year. As a result, even “simple returns” now demand technical accuracy, process discipline, and familiarity with Canada’s digital tax environment- making strong foundational filing skills a professional necessity.

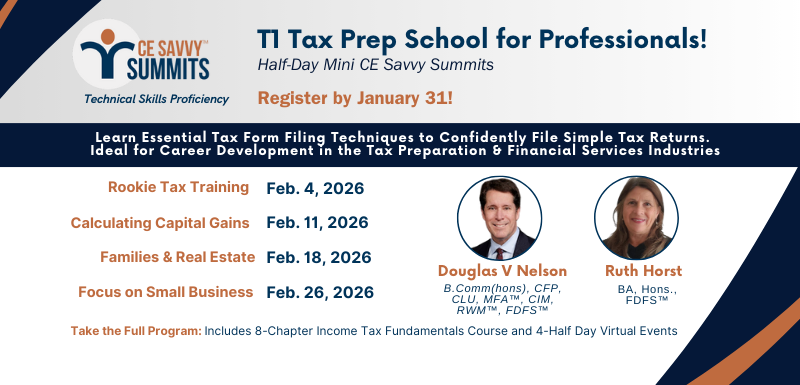

KB T1 Tax School for Professionals

While tax legislation evolves, the fundamentals of accurate personal tax filing remain constant. Errors at the entry level can create downstream issues for clients and firms alike, particularly as CRA systems rely more heavily on automation and cross-verification.

This four-part CE Savvy Mini Summit series was developed to help participants build and reinforce the practical skills required to file personal tax returns clearly, correctly, and with confidence - starting with simple returns and progressing through more complex scenarios.

A Structured Approach to Building Tax Filing Expertise

February 4: Rookie Tax Training, Families, Employees and Investors. The first event in the series focuses on confidently filing simple personal tax returns at a professional standard.  Delivered in a half-day, live virtual format, it emphasizes practical application rather than theory, making it especially valuable for those new to tax preparation or supporting tax work within accounting or financial services practices.

Delivered in a half-day, live virtual format, it emphasizes practical application rather than theory, making it especially valuable for those new to tax preparation or supporting tax work within accounting or financial services practices.

Participants are guided through the core elements of personal tax filing, including:

- Canada’s Digital Tax System

- Reporting Income

- Introduction to Claiming Deductions

- Introduction to Non-Refundable Tax Credits

- Reporting Income from Self-Employment

- Introduction to Capital Gains Reporting

- Introduction to Report Income from Rental Properties

Who Should Attend?

This series is designed for:

- New and aspiring tax preparers

- Professionals transitioning into tax or financial services roles

- Administrative and junior team members supporting tax practices

- Practitioners seeking a structured refresher on personal tax filing fundamentals

Whether taken individually or as a complete series, the CE Savvy Mini Summits support both skill development and career advancement.

Earn Your Income Tax Preparer Certificate

Participants who complete all four CE Savvy Mini Summits earn an Income Tax Preparer Certificate, along with third-party accredited continuing education credits. The certificate provides formal recognition of foundational tax filing competency and supports professional credibility in a high-demand field, and includes access to the 8-Chapter Canada’s Income Tax Fundamentals course.

Proven Learning for Real-World Practice

Now in its second year, the CE Savvy Mini Summit series reflects Knowledge Bureau’s commitment to practical, defensible education that supports real-world tax preparation. By focusing on form-by-form filing techniques and progressive skill-building, the series continues to help professionals build confidence—and competence—where it matters most.