Last updated: January 07 2026

Tax and Estate Planning: Train, Mentor and Introduce New Skillsets to Your Clients

Evelyn Jacks

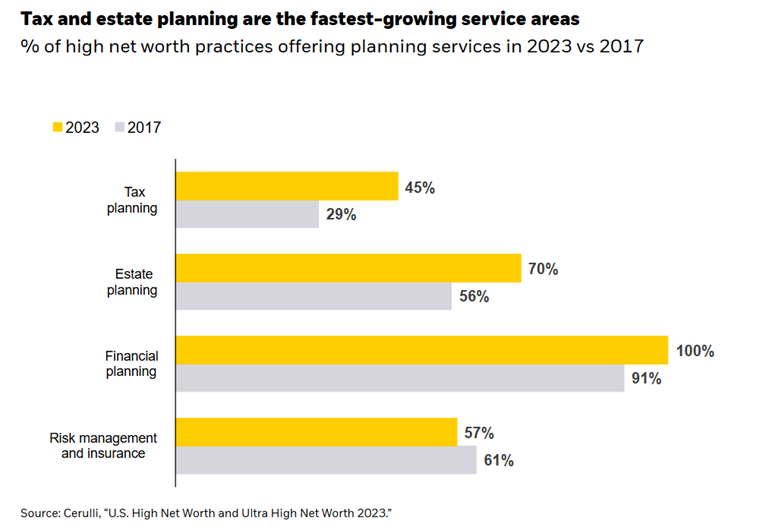

To prepare for a high quality, efficient and profitable tax season, you can count on Knowledge Bureau for a world class educational experience customized to your office needs. Here’s why that’s important: tax and estate planning are the fastest-growing service areas in the financial services. To embrace this trend with professionalism and business acumen, the key to success is your highly trained team. Consider the following:

Why Growth is the Priority for Your Tax Business. Tax accounting and financial services practices positioned to grow and meet new market demands will focus on training new human resources ready to navigate a broad spectrum of client scenarios. Note the recent growth in demand for tax planning services - 16%; higher than in estate planning - 14% and in financial planning: 9%

To deliver on the required full service solutions - tax preparation, tax planning and wealth management – requires deep and confident tax knowledge by every member of the team. But not every member needs the same knowledge palate. That is the big insight for what otherwise can seem like a staggering obstacle – how to bring the whole team up to speed.

Knowledge Diversity Frees Up Time for Complexity. With Knowledge Bureau at your side as your training partner, you can confidently introduce your clients to your team roster, their diversified new qualifications, and their specific role in the tax filing process using an intergenerational approach. This investment will free up time for owner-managers and senior staff to work on more complex returns for older, wealthier family members while new or less experienced members focus on simpler filings.

Centres of Excellence Scale Talent Outputs. An investment in a customized and workplace diversified learning program, prepares your whole team work together to embrace important demographic changes, for example, job terminations, retirements that include significant severance packages, the sale of a business or the onset of illness during the succession or estate planning process, or returns for new entrepreneurs or younger families.

This is about rising to the occasion as a highly trained, specialized team to provide accurate and astute tax and financial planning services triggered by your clients’ big life events and financial changes.

How to do it quickly? It’s easy when you invest in developing centres of knowledge excellence within your firm that puts a spotlight on a diversity of specialized talent.

Invest in New Training Pathways: Knowledge solutions, in other words, can easily to be customized to fit your clients’ more complex needs with Knowledge Bureau’s real time approach. You can start anytime, 24/7 and add team members as you need to.

Traditionally, professional training meant starting every team member with a fundamental tax course and followed by staggered multi-year training regimes.

Today’s solutions, however, are sleeker and more nimble thanks in large part to technological advances and the ability for people to train conveniently in home or office 24/7. Plus courses and credentials can be customized in three ways: to each individual’s knowledge level, to the roles within your organization and in response to the variety of client profiles being served.

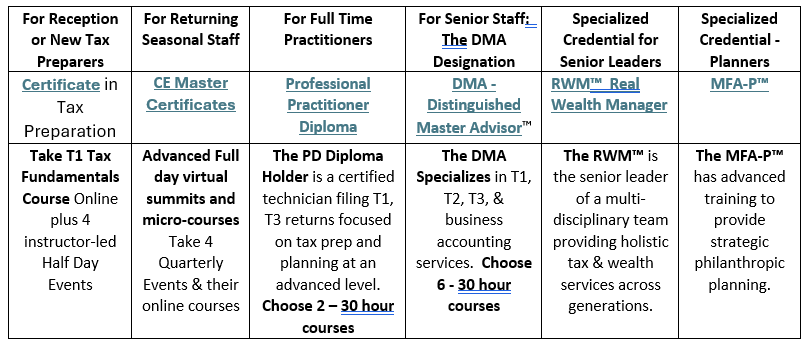

This is possible through a well-structured, concurrent online training pathway from Knowledge Bureau, designed for every member of your team, regardless of experience level. As an example, here are five pathways to consider for an office of five advisors:

Act now. We can help you identify your workplace training needs. Our friendly and experienced educational consultants can guide you to choose the workplace training program right for your firm. And we invite you to check out our new 2026 Course Catalogue today.

Pro Tax Tip: We offer an instalment plan, course switches at no charge and a free trial with a money back guarantee.

Learn More and Enrol: Knowledge Bureau 2026 Course Catalogue

Our Money Back Guarantee: Students may participate in a risk-free trial of the first chapter of a certificate course for seven days. There are no refunds after seven days from initial registration, or if you start chapter 2. See detailed terms & conditions for additional academic policies and refund policies.