Last updated: October 07 2025

The Not-so-Great Tax Cut

Geoff Currier and Evelyn Jacks

“I’m proud to pay taxes but I could be just as proud for half the amount.” This quote from 1950’s American broadcaster Arthur Godfrey, highlights the classic government dilemma, currently the subject of a U.S. government shutdown that threatens the jobs of thousands of government workers: who pays for the debt government spending compounds? It’s a question Canadians will grapple with as well, as the November 4 Federal Budget approaches with. At issue? The wisdom of this 14% solution.

The Backdrop: Effective July 1, 2025 the lowest marginal personal income tax rate dropped from 15% to 14% on income up to $57,375. The federal government claimed in June that this election promise to cut taxes will save a two-income Canadian family up to $840 a year and generate savings for 22 million Canadians. The actual rate for 2025 will be calculated at 14.5%, as the measure was introduced halfway through the year.

The Numbers: The math on exactly how much will be saved has been disputed. According to the Parliamentary Budget Office (PBO), a couple with a child earning in the second income bracket would get the closest to the Liberals’ claim with an average of about $750 in savings. That works out to $14.42 a week.

But, most single Canadians should expect to see a much smaller impact on their bottom line. The PBO estimates that rate reduction will save those taxpayers an average of $110 this year, rising to an average of $200 by 2029-30. That’s 30 cents a day.

The Effect of the Not So Great Tax Cut: While it may not be life changing for taxpayers, this not so great tax cut, will be impactful in terms of government finances. The PBO says the move will cost the government $4.2 billion this year alone and that figure will increase to $6.4 billion by 2029-30.

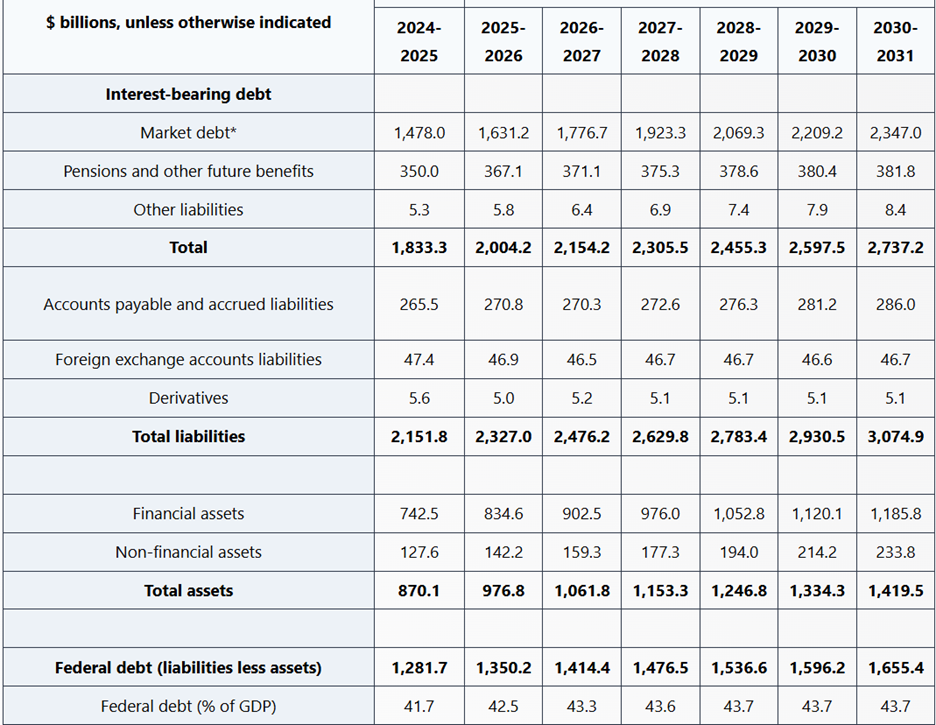

Worse, over the short term, the average deficit (that’s overspending compared to revenue intake) is expected to be $60 Billion a year. The debt keeps climbing to dizzying heights and that means significantly higher interest costs that will wipe out money for social benefits. The not-so-great tax cut contributes to this problem, so does anticipated military spending, anticipated to rise to 5% of GDP by 2025 and the Canada Builds Homes initiative to name a few:

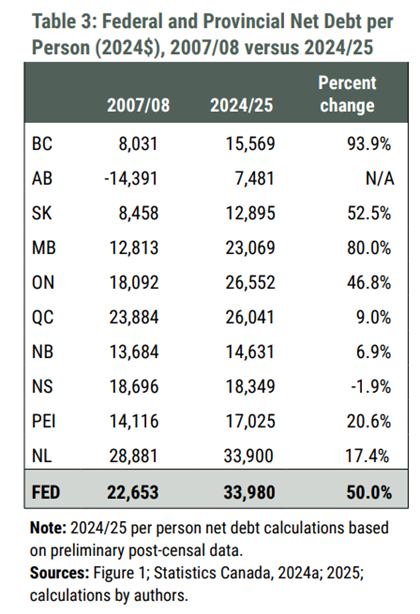

For an economy the size of Canada’s, these numbers are alarming, especially because there are ten other provinces and two territories which are significantly indebted as well. The Fraser Institute’s 2025 study on Canada’s growing debt burden summarizes this problem well, in terms of what each Canadian owes in future taxes, as a result.

Tax Credits Will Be Reduced. Worse, this tax rate cut to 14% on income in the lowest tax bracket actually reduces tax credits for millions. It’s a case of the large print giveth and the small print taketh away.

The PBO says the actual cost in revenue will be closer to $9.5 billion in 2025-26 but that loss of revenue will be offset by $4.2 billion in the clawback of various federal tax credits.

The value of most of the tax credits claimed by your clients from 2025 onward will decrease. Simply put, if your clients end up claiming an amount of non-refundable tax credits which ends up being greater than the lowest marginal tax bracket, they could end up paying more income tax.

In June the PBO released its report on the tax change, revealing that when the calculations that now reduce the non-refundable tax credit like the basic personal amount and age credit are taken into account, lower income Canadians will see a benefit of $90 in 2026-27, which works out to $1.73 a week,” compared to $330 for all other tax filers.

In short, the shift from 15% to 14% will have a greater impact on those earning $57,375 and more, rather than those in the lowest income bracket.

Other critics, such as the Fraser Institute, state in a May 26th article “ the design of the tax cut (beyond the fact that this tax cut is paid for by borrowed money) limits (the government’s) ability to improve overall economic growth and prosperity.”

Most astute taxpayers will also know that the loss of revenue for the federal government will not be worth it as we plunge deeper into intergenerational debt.

Bottom Line. Ultimately, as Arthur Godfrey noted, any reduction in the taxes Canadians pay is welcome. However, in this case, the euphoria of this politically popular tax cut could wear off quickly when Canadians realize just how tiny it is, and what the ultimate price is.

“Who Pays?” is clear: it’s tomorrow’s taxpayers. And, if you are working with the mid and upper middle income clients this is supposed to help, here is a realty check[1]:

“The top 20 per cent of income-earning families already pay more than half (56.9 per cent) of total taxes including personal income, sales and property taxes . . .and just under two thirds of all personal income taxes (64.5 percent) in Canada, while receiving less than half of the country’s family income (47.8 percent).”

It’s quite possible they can expect to pay much more, down the line.

Don’t miss the November 5 CE Summit for full budget analysis and year end tax planning for professional tax and financial advisors.

[1] The Fraser Institute, Measuring Progressivity in Canada’s Tax System, 2025 Edition,