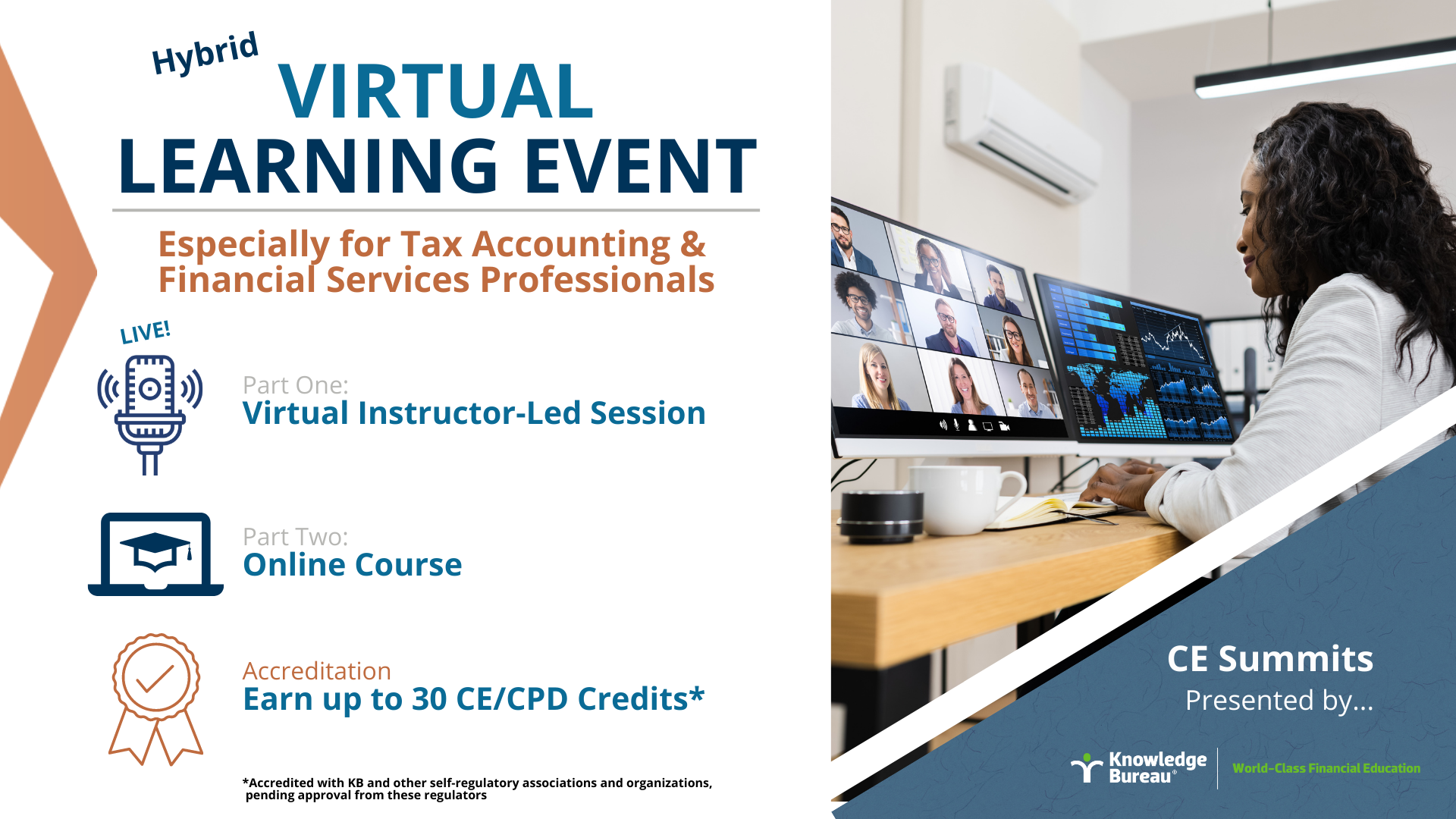

Virtual CE Summit

September 20, 2023

Theme: Audit Defence

Who Should Attend?

This Virtual CE Summit is ideal for training staff working in independent tax filing firms, CPAs in public practice, financial services firms, public trustees, legal assistants, municipal officers, payroll and software companies who employ staff involved with Tax Auditing.

Why Attend?

Learn the most important information that you need to help your clients make informed decisions all from the comfort of your office without the hassles of travel.

Accreditation Reminder

Earn CE/CPD credits from Knowledge Bureau and other self-regulatory associations and organizations, pending approval from these regulators

This CE Summit qualifies for Knowledge Bureau designate re-licensing requirements (deadline: June 30 each year).

Why is this Timely?

The CE Summits address timely issues affecting financial decision making today and for years to come.

Every year there are significant tax and economic changes announced in federal budgets and economic updates from the Finance department. This information is necessary to facilitate end-to-end financial planning: from filing accurate and audit-proof tax returns, to planning investment, retirement, succession, estate and trust solutions.

What’s Included?

Receive outstanding year-end tax planning information from the top experts in personal and corporate tax, and retirement and estate planning, plus:

CE Credits*: IIROC, Insurance Councils, Knowledge Bureau, and other professional organizations.

Post-session: special tuition fees for online studies.

Outstanding networking opportunities with a diverse audience.

*CE Credits are pending approval by regulators.