What’s New at Knowledge Bureau?

About our weekly course news releases:

We are proud to share new courses offerings as we continuously develop cutting edge and immediately implementable courses for our busy students. That’s what makes a Knowledge Bureau education so relevant and unique. Need something specific that you don’t see here? Please let us know about it.

Call 1-866-953-4769

B.C. Regulators Ban Charitable Gifts of Life Insurance

Life insurance and Estate Planning professionals across the country were recently shocked to discover that traditional gifting of life insurance policies to charity is now considered “trafficking” by the British Columbia Financial Services Authority.

Sharing the Love: Announcing the Gratitude Contest Winner & Your Valentine’s Day Gift

The news is big: first, we are delighted to announce the winner of a free registration to The DAC Acuity Conference in Niagara Falls this October 28-30. Next, we have a Valentine’s Day gift for you! And last but not least, something to make you smile: check out the DAC photo gallery of the highly successful 2019 DAC in Puerto Vallarta. Guess who had the most fun?

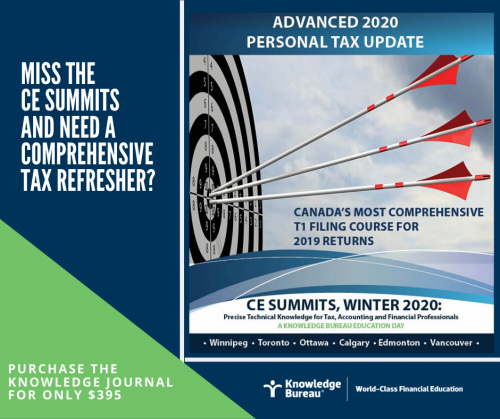

Attendees Rave About the CE Summit Knowledge Journal: Get Yours!

Did you miss the Winter CE Summits? You can purchase the CE Summit January Advanced Tax Update Journals for your team for only $395. Plus, you get the new assignments included for free. Here's why Winter attendees encourage you to get yours: